This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

A hot topic in the finance world in recent months, SPAC stands for Special Purpose Acquisition Company. But, what is a SPAC? Let’s break it down. An intuitive way to think about a SPAC is this – when you invest in a SPAC, you write a blank check to the management team of SPAC and trust them to make wise investment decisions with your money. Basically, at the time of investing in a SPAC, you have no idea what the SPAC will do with your money – you simply know that the SPAC will ‘acquire’ (hence A for acquisition in SPAC) a company, or merge with another company.

Even before the SPAC declares which company it is targeting to acquire, the SPAC becomes a public company (with no commercial operations yet – i.e. no products or services to generate revenues) through an IPO (Initial Public Offering) to be able to trade in the stock market. After that, the SPAC acquires an existing private company and effectively takes the private company public. That is the purpose of a SPAC – to acquire a private company and take it public. The investor in SPAC does not know which private company the SPAC will target, hence they have to trust the management team behind the SPAC (that’s pretty much the only information they have).

Why does the private company need a Special Purpose Acquisition Company?

Private companies can go public on their own via the IPO (Initial Public Offering) route, but going public via SPAC can bring them savings on both cost and time. From the private company’s perspective, SPACs have easier compliance requirements, lower advisory fees, and a shorter lead time to go public. Hence, SPAC is an attractive option for newer private companies that want to go public.

Which Companies Have Gone Public via SPAC?

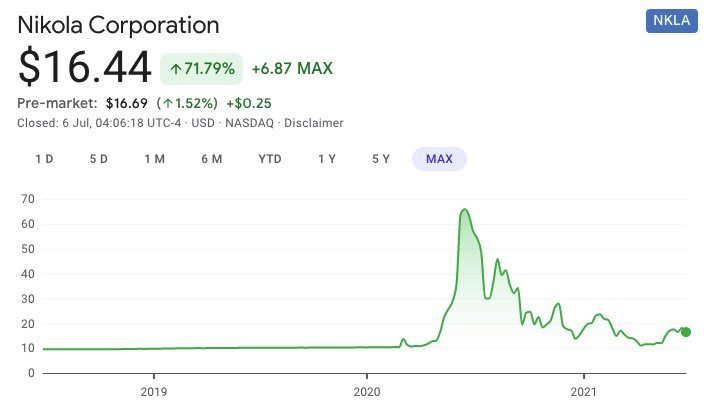

Many companies have taken the SPAC route to go public. The popular ones are DraftKings (DKNG), Virgin Galactic (SPCE), and Nikola Corporation (NKLA). Many others are planning to take the SPAC route to go public due to the cost and time savings advantage.

How Does The SPAC Merger Work?

As we discussed, the SPAC first goes public via an IPO. The SPAC offers its stock to investors at a price, say $10 per share. Using the cash raised in the IPO, the SPAC approaches a target private company with the proposal to merge with (or acquire) them.

Depending on the target company and the percentage ownership the SPAC would have in the company post-merger (can be less than 100%), the stock price can move drastically in either direction. The investors who had given the ‘blank check’ to the SPAC management team, at this stage, have better visibility into the commercial activity, and earnings potential of the company, hence can compute a fair value of the stock.

[image: google finance] Virgin Galactic went public via the SPAC route by merging with Social Capital Hedosophia Holdings. The stock (SPCE) has returned more than 300% to the initial investors, despite high volatility as observed in the price chart.

Should I Invest in a Special Purpose Acquisition Company?

Investing in a SPAC is like writing a blank check and putting your trust in the management team and sponsors of the SPAC. You have to be willing to trust the management team to pick a profitable target company and make a wise investment while merging with or acquiring the target company. It all boils down to the team’s credibility. Having said that, the right management team can sign lucrative deals with an amazing private company and you could see great returns on your investment in the SPAC.

Investing early on in the SPAC is like taking a leap of faith in the exchange for very high potential returns. You can also invest in the SPAC after it announces (or completes) a merger with the target company. The potential returns could get much lower, but you would have higher visibility into what you are investing.

You may choose whether to invest, when to invest, or whether not to invest in a SPAC depending on your appetite for risk. While it could be rewarding, investing in SPAC comes with its fair share of risk.

Can I Buy Call Options on SPACs?

Yes, you can trade stock options and buy and sell call options and put options on some SPAC stocks such as DraftKings Inc. (DKNG) and Virgin Galactic Holdings, Inc. (SPCE). Take a look at the option chain for DKNG here

Caveats

Difficult to Estimate Fair Value

Since SPACs do not have commercial activities or any past earnings, there is no data point or comparable to estimate whether you are paying a fair value for the shares.

Opportunity Costs

Until a target private company is announced by the SPAC management team, the investor money is parked in low-risk, low-return accounts or assets. Depending on how long it stays there, you might be missing out on potential gains elsewhere – that’s the opportunity cost associated with a SPAC. There is generally a deadline of 2 years before which the SPAC has to find a target company, as an investor, you might want that to happen sooner rather than later.

Chance of Sub-Optimal Returns

Another risk here is that the SPAC might get desperate and overpay for a target company to meet its deadline, potentially jeopardizing the investors’ returns.

Risk of the Unknown

Private companies going public via SPAC generally present their future revenue expectations. While projections are great to look at, there is no guarantee that the projections will play out exactly as the company expects. The investor needs to factor in the risk ‘of the unknown’ before investing. It is especially important because SPACs help newer private companies, and their projections can be way off. On the flip side, the returns can be phenomenal if the company gets it right. SPACs should be viewed as a high-risk, high reward opportunity.

Bestseller Personal Finance Books

For beginner investors, consider relatively safer assets such as large-cap stocks and ETFs.

[image: google finance] Nikola Corporation went public via the SPAC route by merging with VectoIQ Acquisition. The stock (NKLA) initially spiked up over 600% but has since come down significantly after the company’s projections were evaluated and scrutinized.

Is SPAC a New Concept? Why is it So Popular Now?

SPACs have existed since a long time ago, but recently with a lot of social media buzz and the aforementioned benefits of lower costs, easier compliance, and shorter time to go public have spurred a lot of private companies to this route to go public. In an uncertain time like this, with the COVID-19 pandemic dominating much of 2020 and the first half of 2021 (with no guaranteed end date, yet), newer private companies want to reduce their risks and costs as much as possible, hence they choose SPAC. Going public via SPAC ensures the private company has access to capital, irrespective of volatility in the market, and they can also negotiate their company’s valuation with the SPAC management.

How do the Sponsors Benefit From It?

The sponsors and management team of a SPAC put down a nominal amount of money to form the SPAC. In return, they control about 20% ownership of the SPAC in form of ‘Founder Shares’. Depending on the target private company the SPAC can acquire or merge with, the 20% stake in the SPAC can be worth millions or even billions of dollars. All of this for a relatively very low initial investment.

Quick Recap

SPACs are gaining popularity among early-stage private companies as a preferred route to go public because of cost savings, speed, easier compliance, and easy access to capital that practically isolates the private company from market volatility. The SPAC sponsors can make an enormous return on their money. While the common investors can also get great returns, they have to invest early in the SPAC with little to no information about which company the SPAC will acquire or merge with. It should be viewed as a high-risk, high reward play.

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents