This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

Amazon recently announced, on March 9, 2022, that the company will soon be performing a 20-for-1 Amazon Stock Split. A few months ago Google Stock Split was in the news when Alphabet (Google’s parent company) announced on Feb 1, 2022, a 20-for-1 forward stock split. Let’s see how these events such as the Google Stock Split and Amazon Stock Split impact investors.

- What is a Forward Stock Split?

- Google Stock Split History

- Amazon Stock Split History

- Why do Companies Split Stocks?

- The Era of Partial Shares or Fractional Shares

- Stock Split History: Other Companies That Have Performed Forward Stock Splits

- What is a Reverse Stock Split?

- Conclusion on Forward Stock Splits and Reverse Stock Splits

What is a Forward Stock Split?

When companies decide to increase the no. of shares outstanding, they can do so by splitting the stock ‘2-for-1’ or ‘3-for-1’ or in any ratio that they deem fit. In the case of a 3-for-1 stock split, a shareholder who owns 100 shares (say for company ABC) valued at $30 each gets 300 shares valued at $10 each after the 3-for-1 stock split. When the number of shares increases in case of stock splitting, it is called Forward Stock Split, or simply Stock Split.

Please note that the total value of the shareholder’s holding does not change due to the stock split, i.e. 100 * $30 = 300 * $10 = $3000.

Google Stock Split History

There have been 2 Google Stock Spilts till date. The first Google Stock Split was in April 2014 when Google performed a 2-for-1 forward stock split. The second Google Stock Split was in July 2022 when Google performed a 20-for-1 forward stock split.

| Google Stock Split History | |

| Stock Split | Date |

| 2–for-1 | April 3, 2014 |

| 20-for-1 | July 1, 2022 |

Amazon Stock Split History

Amazon has performed forward stock splits 3 times, the first (2-for-1) Amazon stock split was done in June 1988, the second Amazon stock split (3-for-1) was done in January 1999, and the third stock split (2-for-1) in September 1999. With the price per share over $3000 in March 2022, the management announced another Amazon stock split (20-for-1). The 20-for-1 Amazon stock split happened in June of the year 2022.

| Amazon Stock Split History | |

| Stock Split | Date |

| 2 – 1 | June 2, 1988 |

| 3 – 1 | Jan 5, 1999 |

| 2 – 1 | Sept 2, 1999 |

| 20-for-1 | June 3, 2022 |

Will Amazon Stock Split Again After 2022?

The stock split in June 2022 was a 20-for-1 stock split. That brought down the price per share of Amazon stock significantly. For the next few years, we don’t foresee another stock split, unless something makes the stock price skyrocket (or management decides to, for other reasons).

Effect of Forward Stock Split on Earnings per share (EPS) and Price to Earnings (PE) ratio

After the Forward Stock Split, the earnings per share remain the same, and also the P/E ratio remains the same. For example, if the earnings per share (EPS) for ABC company is $1.00 and there are 100 million shares currently priced at $30 each, PE = 30/1 = 30. After a 3 for 1 split, the number of shares becomes 300 million priced at $10 each, EPS goes down on $0.33, and PE = 10/0.33 = 30.

Why do Companies Split Stocks?

Companies split their stocks primarily to make the share price affordable to more investors.

“We want Apple stock to be more accessible to a broader base of investors.“

-investor.apple.com

“The decision to split the stock was made by Microsoft’s Board of Directors, based on a desire to make our stock more accessible to a broader range of investors“

-microsoft.com/en-us/Investor

If the stock price is too high, say $3300 for 1 share of Amazon stock, many people will have to save up to $3300 to buy 1 share. This can keep a lot of new and young investors away from investing in the company’s stock. Let’s say if Amazon does a 10 for 1 stock split, the new share price would be $330, making it affordable to many more investors.

Another reason why a company may consider a forward stock split is to make their derivates market more active. For example, if a stock trades at $3,000 per share, buying a call option or a put option is also expensive, since the stock options are contracts of 100 shares. By reducing the cost per share, more and more retail investors can get involved in the stock options.

The Era of Partial Shares or Fractional Shares

Nowadays you can buy partial shares of many stocks and ETFs. So, the rationale of making the stock accessible by lowering the price per share will become less relevant as more and more brokers offer this feature to their investors. You can buy partial shares on newer platforms such as Robinhood and M1 Finance. Some other brokers such as Fidelity and Schwab are also offering this opportunity to investors.

Stock Split History: Other Companies That Have Performed Forward Stock Splits

Many companies have performed forward stock splits in the past. A few popular ones are listed below.

| Companies That Have Performed A Stock Split |

|---|

| Apple |

| Microsoft |

| Amazon |

| Alphabet (Google parent) |

| Berkshire Hathaway Inc |

| Johnson and Johnson |

| Procter and Gamble |

| NVIDIA |

| Visa |

| United Health Group |

| JPMorgan Chase |

| Mastercard |

| Home Depot |

| Verizon Communications |

| Adobe |

| Southwest Airlines |

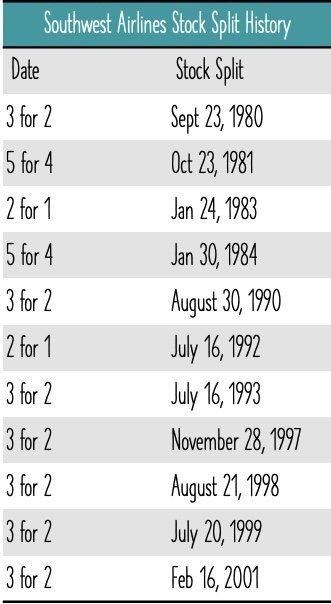

Southwest Airlines Stock Split History

Southwest Airlines have performed forward stock splits 11 times between 1980 and 2001. All the Southwest Airlines stock splits have been forward stock splits. The stock split details can be seen in the table below.

| Southwest Airlines Stock Split History | |

| Date | Stock Split |

| 3 for 2 | Sept 23, 1980 |

| 5 for 4 | Oct 23, 1981 |

| 2 for 1 | Jan 24, 1983 |

| 5 for 4 | Jan 30, 1984 |

| 3 for 2 | August 30, 1990 |

| 2 for 1 | July 16, 1992 |

| 3 for 2 | July 16, 1993 |

| 3 for 2 | November 28, 1997 |

| 3 for 2 | August 21, 1998 |

| 3 for 2 | July 20, 1999 |

| 3 for 2 | Feb 16, 2001 |

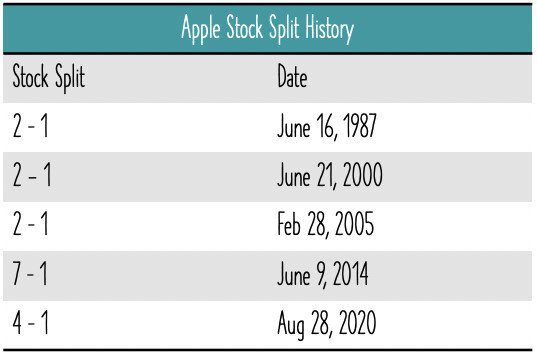

Apple Stock Split History

Apple has performed forward stock splits 5 times, the first (2 for 1) being in June 1987, and the latest (4 for 1) in Aug 2020.

Bestseller Personal Finance Books

| Apple | |

| Split | Date |

| 2 – 1 | June 16, 1987 |

| 2 – 1 | June 21, 2000 |

| 2 – 1 | Feb 28, 2005 |

| 7 – 1 | June 9, 2014 |

| 4 – 1 | Aug 28, 2020 |

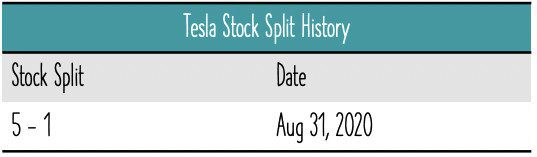

Tesla Stock Split History

Tesla has performed a forward stock split 1 time only, 5 for 1, in Aug 2020.

| Tesla | |

| Split | Date |

| 5 – 1 | Aug 31, 2020 |

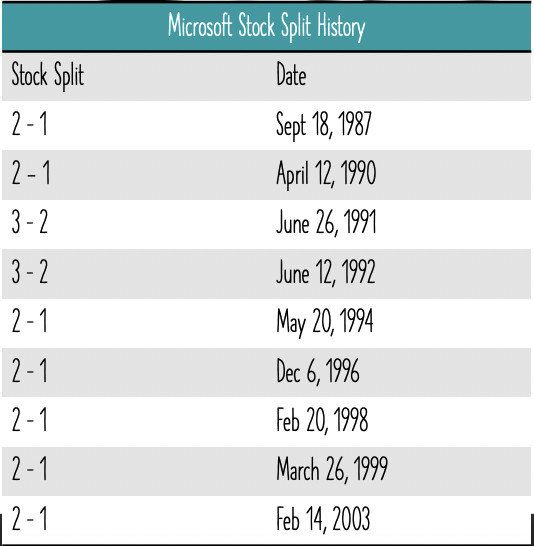

Microsoft Stock Split History

Microsoft has performed forward stock splits 9 times, the first(2 for 1) being in September 1987, and the latest (2 for 1) in February 2003.

| Microsoft | |

| Split | Date |

| 2 – 1 | Sept 18, 1987 |

| 2 – 1 | April 12, 1990 |

| 3 – 2 | June 26, 1991 |

| 3 – 2 | June 12, 1992 |

| 2 – 1 | May 20, 1994 |

| 2 – 1 | Dec 6, 1996 |

| 2 – 1 | Feb 20, 1998 |

| 2 – 1 | March 26, 1999 |

| 2 – 1 | Feb 14, 2003 |

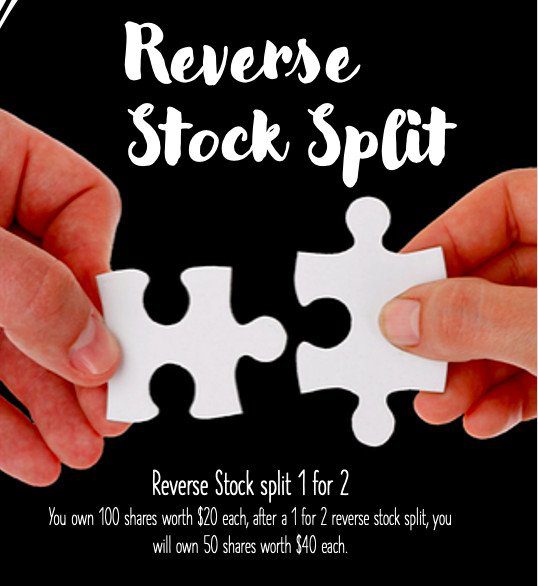

What is a Reverse Stock Split?

A ‘reverse stock split‘ is the action taken by a company to consolidate its shares and reduce the number of shares outstanding. If a company performs a reverse stock split, say 1 for 2, a shareholder who owns 200 shares valued at $10 each would get 100 shares valued at $20 each. Please note that here also, the total value of the shareholder’s holding does not change due to reverse stock split, i.e. 200 * $10 = 100 * $20 = $2000.

Reverse stock splits are done mostly when the stock price falls below a certain level, and the company wants to avoid being labeled a risky stock or even a penny stock (in case the price falls below $1). The price per share gets an artificial boost and the company can avoid the stock being delisted from a major exchange.

Example of a Reverse Stock Split

In June 2003 Priceline (now Booking Holdings BKNG) performed a 1 for 6 reverse stock split. You can read more about it here

Conclusion on Forward Stock Splits and Reverse Stock Splits

The fundamentals of a business determine the long-term value of the stock. Increasing or decreasing the no. of shares and proportionately adjusting the price per share is not a true value creator and long-term investors shouldn’t be bothered by it. Even though we observed increased optimism among the investors as seen in the stock price rise on the day of the Google Stock Split announcement and Amazon Stock Split announcement.

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents