This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

When will the stock market crash? What should I do when the stock market crashes? Are we in a bear market? What is the difference between recession vs stock market crash? All of these are questions that I hear from my friends and colleagues far too often. So, let’s try and answer all of these questions in this article.

- Recession Definition

- Recession vs Depression – What is The Difference?

- Let’s Understand The Difference Between Stock Market Crash, Correction, and Bear Market

- List of Previous Bear Markets in the US

- Are We In a Bear Market?

- Investing During Market Crashes

- When Will The Stock Market Crash?

Recession Definition

Let’s start with understanding recession. So, What is a recession? When economic activity declines and the change in the gross domestic product (GDP) is negative for two successive quarters, economists consider it a recession.

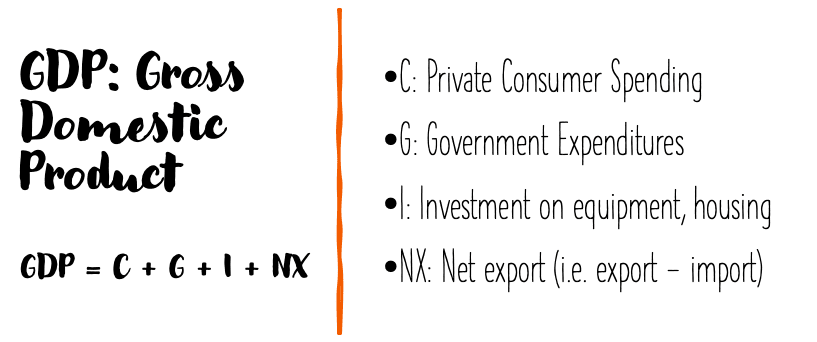

What is GDP? Gross domestic product (GDP) is the sum of the following components:

- Private Consumer Spending

- Government Expenditures

- Investment on Capital equipment, housing, inventories

- Net Exports (total exports – total imports)

Recession vs Depression – What is The Difference?

There’s no textbook definition that separates a recession from a depression. Generally speaking, a more severe form of recession is referred to as a depression. When a recession spans years instead of months and impacts the global economy rather than a particular country, a recession is considered a depression.

So far there has been one recorded depression in the US, starting in 1929 and ending in 1939. It lasted a decade, with unemployment hitting 25% at one point. A notable event was the ‘Black Thursday’ on Oct 24, 1929, which sent the stock market crashing, followed by reduced consumer spending, home foreclosures, and job losses, painting a grim economic outlook for the country.

Check the latest numbers on: Unemployment Rate, CPI Inflation, GDP Growth Rate

Most Recent Recession: Recession in 2020

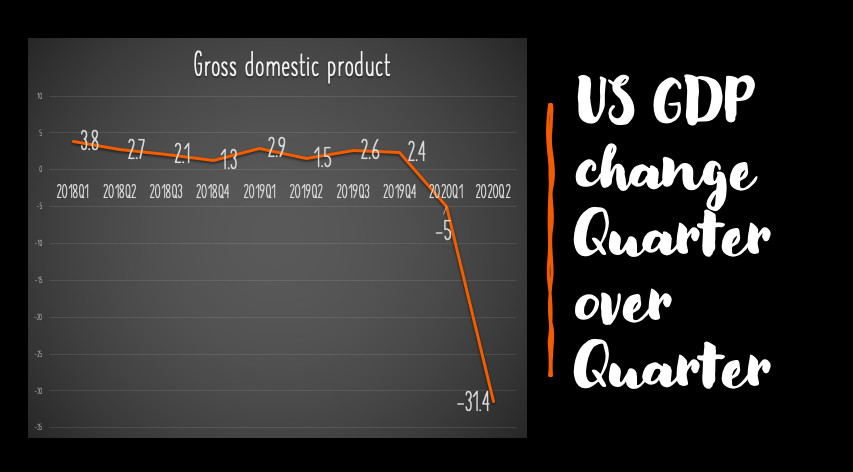

In the first two quarters of the year 2020, the US GDP saw a decline from previous quarters, -5% in Q1 and -31.4% in Q2. The declines were primarily driven by the disruption in trade activities due to the COVID-19 restrictions such as lockdowns, reduced business activity, cross-border travel bans, reduced international trade, etc.

[update] The Real GDP change reported (advance estimate) on Oct 29, 2020, for 2020 Q3 is +33.1% according to https://fred.stlouisfed.org/ indicating a strong rebound in the economy.

Are we in a recession now?

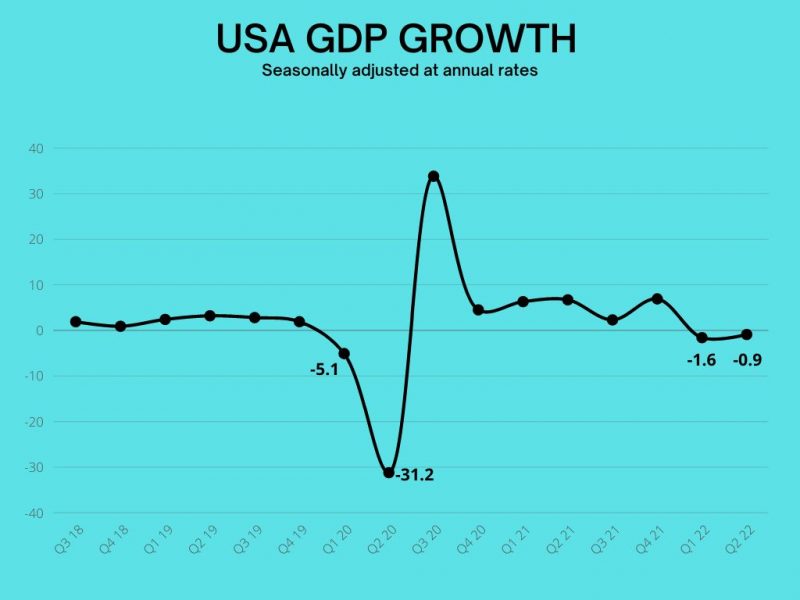

As of August 2022, according to the advanced estimates for GDP in Q2 2022, the United States has experienced two consecutive quarters of negative GDP growth, thus technically we can call it a recession.

Let’s Understand The Difference Between Stock Market Crash, Correction, and Bear Market

Recession and stock market crashes are not really the same. Recession is measured on the Gross Domestic Product of a country, while correction and crash are measured on the Stock Market Index.

Here’s we’ll discuss the most common terms used in reference to stock market declines – stock market crash, stock market correction, bear market, and bull market.

Stock Market Correction

When a major index (S&P 500 or Dow Jones Industrial Average) falls more than 10% from its recent peak within the rolling 52-week period, the decline is considered a stock market correction.

Stock Market Crash

When the stock market correction (i.e. S&P 500 or Dow Index falls by 10% or more) happens in a short span of time – usually a day or a few days, it is considered a stock market crash.

Bear Market

When a major stock index (such as S&P 500 or Dow Jones Industrial Average) declines by 20% from its most recent peak within the rolling 52-week period, it is considered a bear market. The onset of a bear market practically ends the ‘bull market’

Bestseller Personal Finance Books

Bull Market

When the stock index rises by 20% from its most recent low (mostly after a bear market), it is considered a bull market. The bull market continues until it experiences a bear market again i.e. the stock index drops again by 20%.

List of Previous Bear Markets in the US

Here’s a list of bear markets identified by 20%+ declines in the S&P 500 since the Great Depression in 1929.

| Bear Market | Onset of Bear Market | Duration | S&P 500 Decline |

|---|---|---|---|

| Great Depression | Sep-29 | 33 months | 86.20% |

| Bear 1937 | Mar-37 | 62 months | 60.00% |

| 1946: End of Post WW2 Demand Surge | May-46 | 37 months | 29.60% |

| Bear 1956 | Aug-56 | 15 months | 21.50% |

| Cuban Missile Crisis | Dec-61 | 6 months | 28.00% |

| Bear 1966 | Feb-66 | 8 months | 36.10% |

| Vietnam War | Nov-68 | 18 months | 36.10% |

| 1973: Oil Crisis | Jan-73 | 21 months | 48.20% |

| Volcker Bear: Stagflation | Nov-80 | 20 months | 27.10% |

| 1987: Fear of Dollar Devaluation | Aug-87 | 3 months | 33.50% |

| Bear 1990 | Jul-90 | 3 months | 19.90% |

| Dot Com Bubble Burst | Mar-00 | 30 months | 49.10% |

| Great Recession- Housing market collapse | Oct-07 | 17 months | 56.40% |

| Covid -19 Pandemic | Feb-20 | 1 month | 33.90% |

| Bear Market | The onset of Bear Market | Duration | S&P 500 Decline |

| Great Depression | September 1929 | 33 months | 86.2% |

| Bear 1937 | March 1937 | 62 months | 60.0% |

| 1946: End of Post WW2 Demand Surge | May 1946 | 37 months | 29.6% |

| Bear 1956 | August 1956 | 15 months | 21.5% |

| Cuban Missile Crisis | December 1961 | 6 months | 28.0% |

| Bear 1966 | February 1966 | 8 months | 36.1% |

| Vietnam War | November 1968 | 18 months | 36.1% |

| 1973: Oil Crisis | January 1973 | 21 months | 48.2% |

| Volcker Bear: Stagflation | November 1980 | 20 months | 27.1% |

| 1987: Fear of Dollar Devaluation | August 1987 | 3 months | 33.5% |

| Bear 1990 | July 1990 | 3 months | 19.9% |

| Dot Com Bubble Burst | March 2000 | 30 months | 49.1% |

| Great Recession- Housing market collapse | October 2007 | 17 months | 56.4% |

| Covid -19 Pandemic | February 2020 | 1 month | 33.9% |

Are We In a Bear Market?

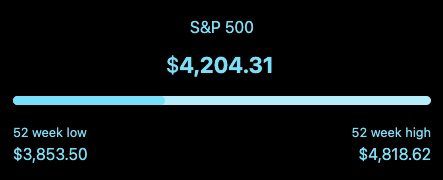

As of this update, on March 12, 2022, if we take a look at the three major US Indices, S&P 500, Nasdaq, and Dow Jones Industrial Average, we observe the following:

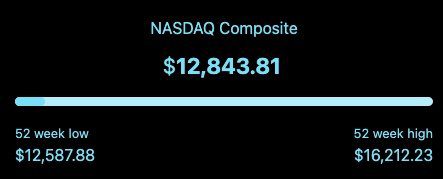

Nasdaq was recently down 22.3% from its 52 Week High. Nasdaq is in a Bear Market.

S&P 500 was recently down 20% from its 52 Week High. S&P 500 is in also in Bear Market Territory

Dow has not been down 20% from its 52 Week High. Dow is currently NOT in a Bear Market.

Investing During Market Crashes

For investors with a long investing horizon, it has always proved beneficial to stay invested in the market, and if possible, to continue investing during a market decline. A lot of panic selling occurs during the market crashes and the stocks tend to be ‘oversold’ to a point where it becomes a great bargain for investors to buy again.

However, investors must note that some individual stocks may never recover after a crash based on their lost earning power due to some company-specific factors. As always, while buying during a crash, it’s important to stay diversified and not put all eggs in one basket. Generally speaking, broad market index funds are a safer bet than individual stocks.

If you can keep your income intact, simply continue investing in the market, dollar cost average, and as the economy recovers, you might be better off than the rest.

When Will The Stock Market Crash?

The truth is – No one knows. Not the guy with twenty lines on a stock price chart, not the guy that identifies 7, 10, 20, or 100-day moving averages, not the guy with twenty TV screens in his home office monitoring 200 stock every microsecond, almost absolutely NO ONE!

A friend of mine funnily said – The bears have correctly predicted 947 of the last 3 market crashes. Honestly, every month of every year there is someone on the TV predicting a stock market crash. If you predict the same thing over and over again, then someday you will be right!

It is nearly impossible to predict the stock market crashes, and that is why we never recommend trying to time the market. Use a balanced approach and invest regularly over long periods of time to take care of the short-term volatility.

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents