This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

Which is The Best Investment App Available Today?

The way people invest in the market has changed dramatically over the past few years. Since Robinhood launched its app in March 2015, hundreds of thousands of millennials signed up for accounts started investing via the app. It started a revolution and has changed the perception of investing – the broker commissions have gone down to $0, the account minimums have gone down to $0, allowing more and more people to get on board and start investing. Which is the best investment app for beginners? Which investing app is best for analytical investors? Can you buy partial shares on Robinhood and Webull and M1 Finance? We will go through all these important considerations in this article.

Here we are comparing three popular investment apps – Robinhood, M1 Finance, and Webull feature by feature so you can decide which one is best for you (or you can open accounts with all three!).

For the purpose of this article, we are comparing to find the best investment app with minimal or zero commissions on trade.

- Which is The Best Investment App Available Today?

- Best Investment App Comparison: Robinhood vs M1 Finance vs WeBull

- 1. Where are these investment apps Robinhood, M1, Webull available?

- 2. Can you trade all US stocks on these apps?

- 3. Can you ‘short sell’ stocks on Robinhood, M1 and WeBull?

- 4. Are Exchange Traded Funds (ETFs) available on Robinhood, M1 and WeBull?

- 5. Can you Automatically Reinvest the Dividends (DRIP – Dividend Reinvestment Plan) on Robinhood, M1 and WeBull?

- 6. Can you Buy Fractional Shares on Robinhood, M1 and WeBull?

- 7. Are Cryptocurrencies such as Bitcoin, Ethereum, and Litecoin available on Robinhood, M1 and WeBull?

- 8. Is Options Trading available on Robinhood, M1 and WeBull?

- 9. The Best Investment Apps Should Have Great Analytics Available. Is good analytics available on the Robinhood, M1 and WeBull apps?

- 10. Do the apps have a Stock Screener?

- 11. Can you schedule your investments automatically?

- 12. Can you create customized portfolios?

- 13. Can you copy hedge fund portfolios?

- 14. What about extended hours trading on Robinhood vs Webull?

- Winner of Best Investment App according to the 14 criteria above

- Comparison Table: Robinhood vs M1 Finance vs WeBull

- To Summarize, Here Are The Key Features:

- Conclusion: Which is the best investment app among Robinhood, Webull and M1 Finance?

- Bonus: Discover Some Cool Features of WeBull

Best Investment App Comparison: Robinhood vs M1 Finance vs WeBull

1. Where are these investment apps Robinhood, M1, Webull available?

- Robinhood: Available on iOS devices (Apple iPhones), Android devices, and web browsers.

- M1 Finance: Available on iOS devices (Apple iPhones), Android devices, and web browsers.

- WeBull: Available on iOS devices (Apple iPhones), Android devices, and web browsers.

Best Investment App Winner for Criteria 1

All three apps

2. Can you trade all US stocks on these apps?

- Robinhood: Yes, most US stocks can be traded on Robinhood.

- M1 Finance: Yes, most US stocks can be traded on M1 Finance.

- WeBull: Most US stocks can be traded on WeBull.

Best Investment App Winner for Criteria 2

All three apps

Read Also: Best Books on Personal Finance

3. Can you ‘short sell’ stocks on Robinhood, M1 and WeBull?

- Robinhood: No, short selling is not available on Robinhood.

- M1 Finance: No, short selling is not available on M1 Finance.

- WeBull: Yes, WeBull allows qualified users to short sell stocks. However, the investor must fully understand short-selling to avoid making costly mistakes.

Best Investment App Winner for Criteria 3

WeBull is the only app among the three to allow Short Selling.

4. Are Exchange Traded Funds (ETFs) available on Robinhood, M1 and WeBull?

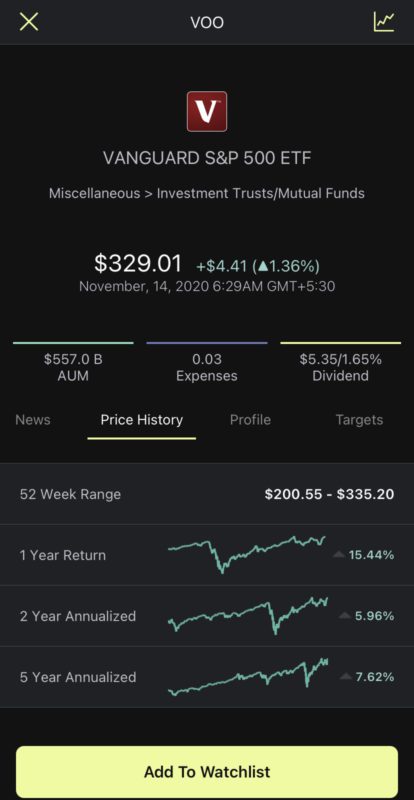

- Robinhood: Yes, most ETFs are available on Robinhood.

- M1 Finance: Yes, most ETFs are available on M1 Finance.

- WeBull: Most ETFs are available on WeBull.

Best Investment App Winner for Criteria 4

All Three Apps

ETF Investing is available on all three apps: Robinhood, M1 Finance and WeBull

5. Can you Automatically Reinvest the Dividends (DRIP – Dividend Reinvestment Plan) on Robinhood, M1 and WeBull?

- Robinhood Dividend Reinvestment: Yes, Robinhood allows automatic reinvestment of dividends.

- M1 Finance Dividend Reinvestment: Yes, M1 finance allows automatic reinvestment of dividends (you can set a threshold for reinvestment) in a pie.

- WeBull Dividend Reinvestment: No, as of writing this article, WeBull does not allow DRIP or automatic reinvestment of dividends.

Best Investment App Winner for Criteria 5

Robinhood and M1.

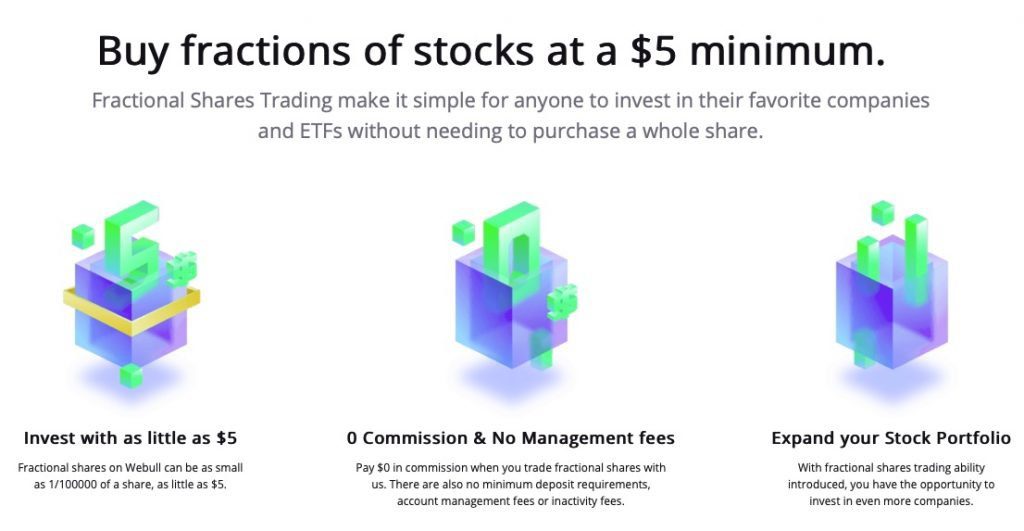

6. Can you Buy Fractional Shares on Robinhood, M1 and WeBull?

- Robinhood: Yes, Robinhood allows users to buy fractional or partial shares, with as little as $1. (Read How to buy partial shares on Robinhood)

- M1 Finance: Yes, M1 finance allows users to buy fractional or partial shares, with as little as $1. (Read How to invest $20 on M1 finance using pies)

- WeBull: Yes, Webull started allowing purchase of fractional shares in July 2021. With a minimum of $5 or 1/100000th of a share (whichever is of higher value)

Best Investment App Winner for Criteria 6

M1, Webull, Robinhood.

Fractional Investing is available on M1 Finance by creating pies and portfolios

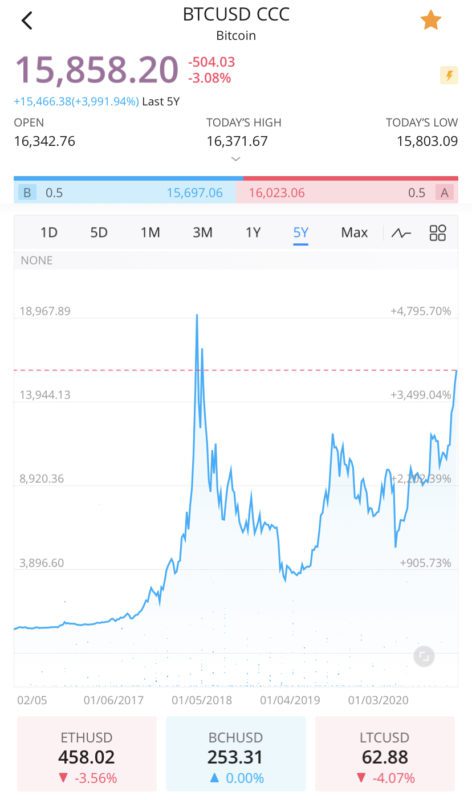

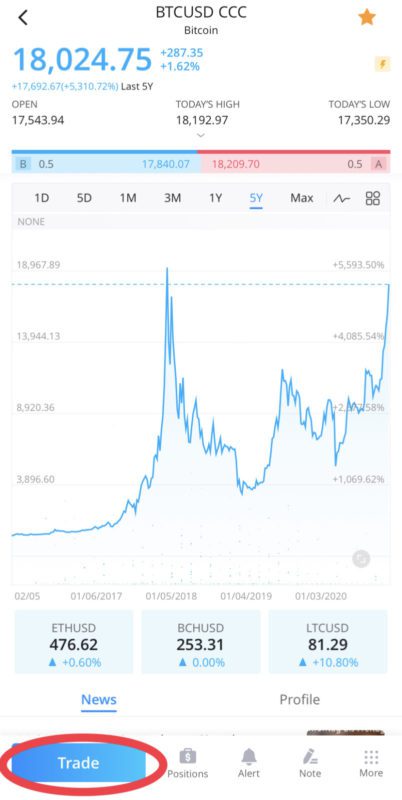

7. Are Cryptocurrencies such as Bitcoin, Ethereum, and Litecoin available on Robinhood, M1 and WeBull?

- Robinhood: Yes, you can buy Bitcoin, Litecoin, and Ethereum on Robinhood (though some state residents cannot buy cryptocurrencies on Robinhood).

- M1 Finance: No, M1 Finance doesn’t allow users to buy cryptocurrencies.

- WeBull: Yes, WeBull now allows users to buy cryptocurrencies. [Earlier, WeBull had been providing only price data and trends on Bitcoin, Ethereum, Litecoin, and other cryptocurrencies.] [updated Nov 19, 2020]

Cryptocurrency trading is available on Robinhood and WeBull

Best Investment App Winner for Criteria 7

WeBull and Robinhood.

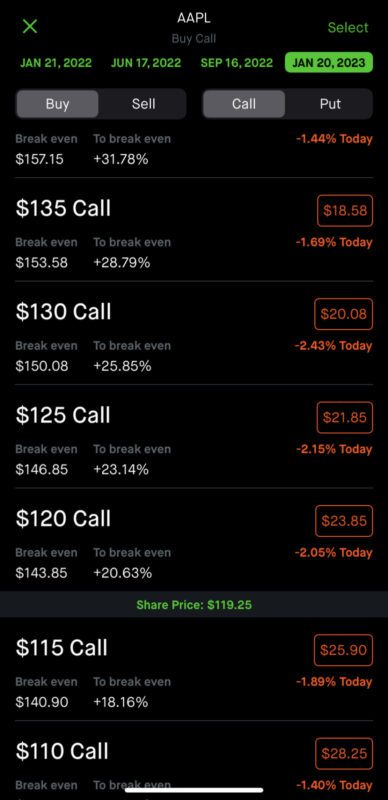

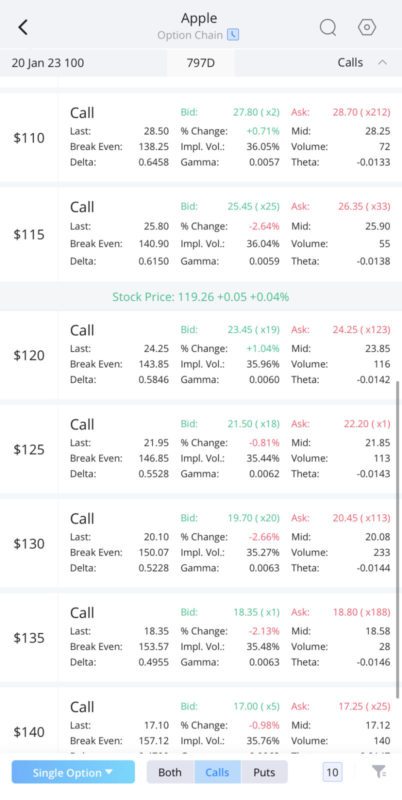

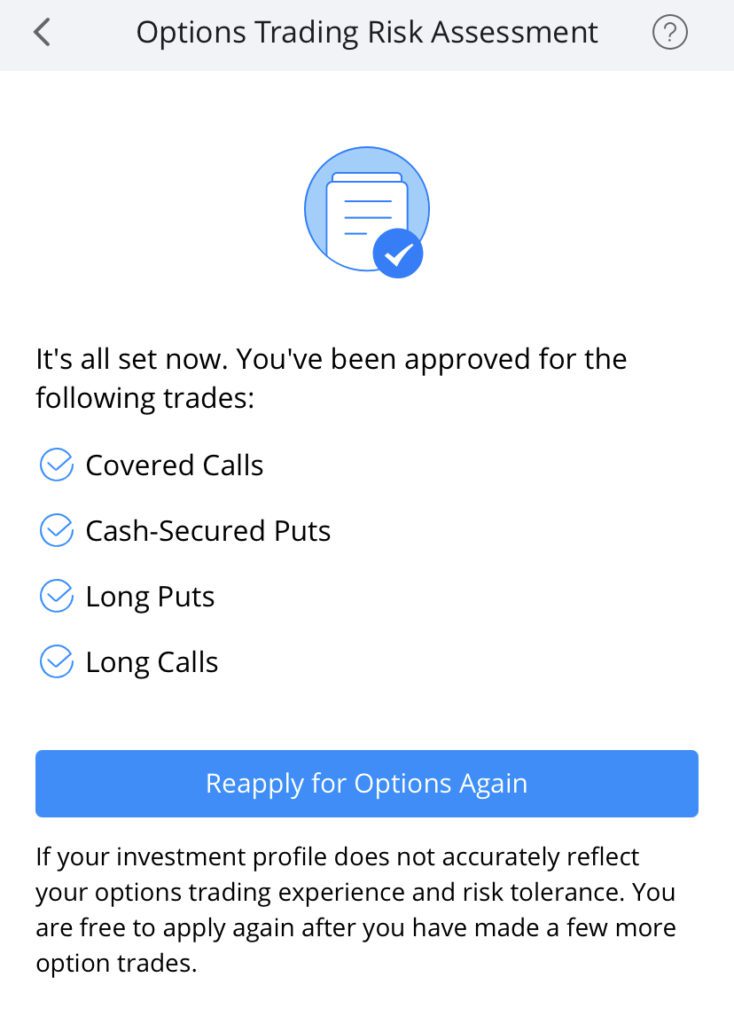

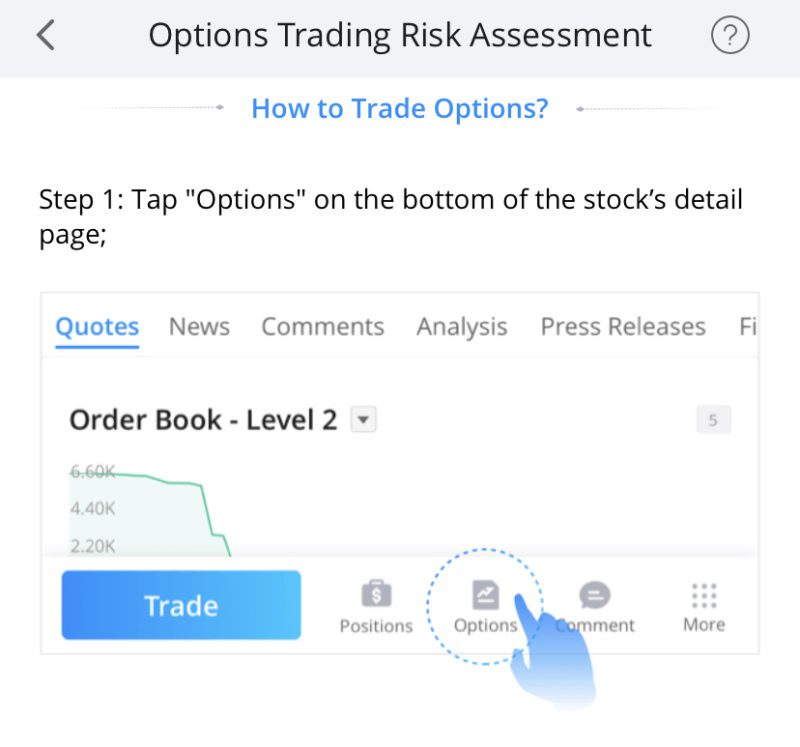

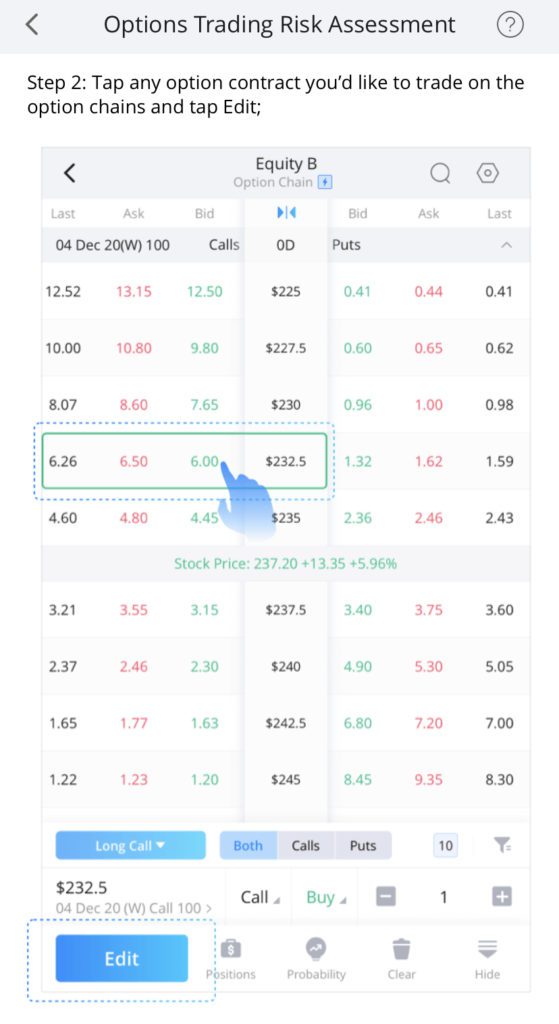

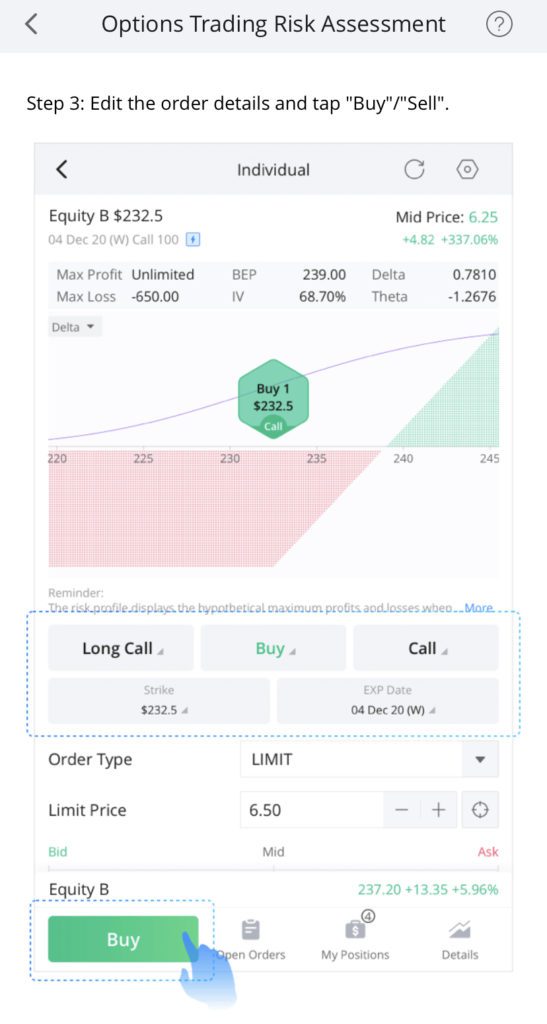

8. Is Options Trading available on Robinhood, M1 and WeBull?

IMPORTANT: Familiarize yourself with options trading – call options, put options etc. before you put any money in options.

Bestseller Personal Finance Books

- Robinhood: Yes, Options trading is available on Robinhood.

- M1 Finance: No, Options trading is not available on M1 finance.

- WeBull: Yes, Options trading is available on WeBull.

Options Trading on Robinhood and WeBull

Options Trading Levels and steps explained on WeBull app

Best Investment App Winner for Criteria 8

WeBull and Robinhood

9. The Best Investment Apps Should Have Great Analytics Available. Is good analytics available on the Robinhood, M1 and WeBull apps?

- Robinhood: Analytics on Robinhood is pretty standard.

- M1 Finance: Analytics on M1 is pretty standard.

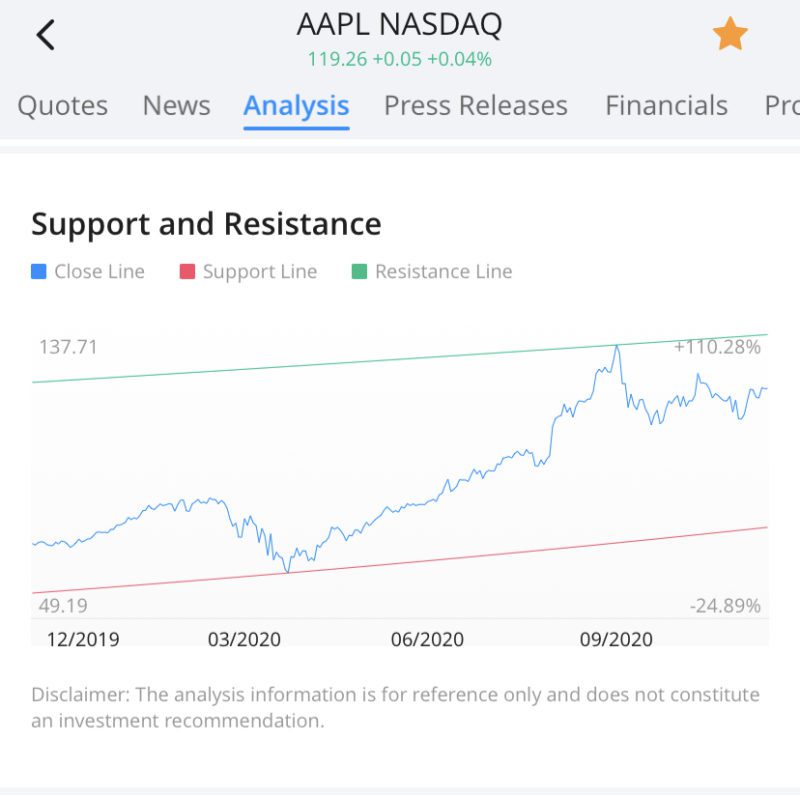

- WeBull: WeBull offers great analytics such as analyst price targets, return on equity, return on assets, net income, earnings per share, short interest etc.

WeBull Analytics- clearly a winner among the three apps compared.

1. Analyst rating and Price Targets on WeBull

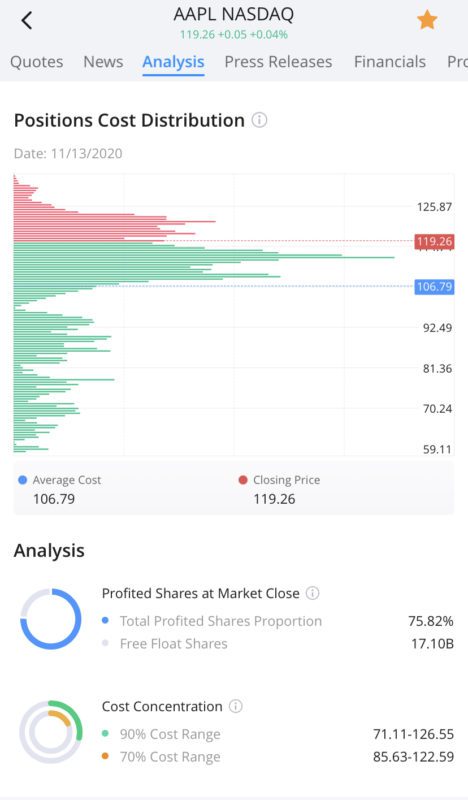

2. Position Cost Distribution on WeBull

3. Short Interest on WeBull

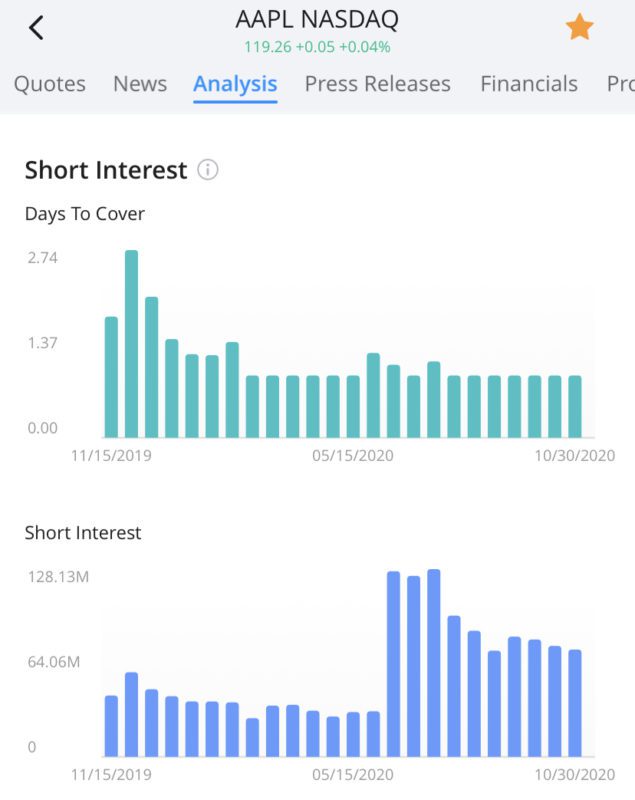

4. Key Indicators such as ROE, ROA, EPS, Net Margin on WeBull

5. Important financials such as Net Income, EPS for the last few quarters on WeBull

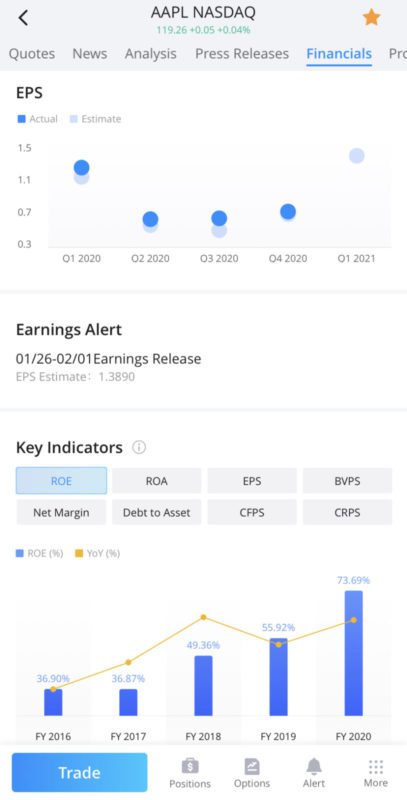

6. Stock Price Support and Resistance levels on WeBull

Best Investment App Winner for Criteria 9

WeBull

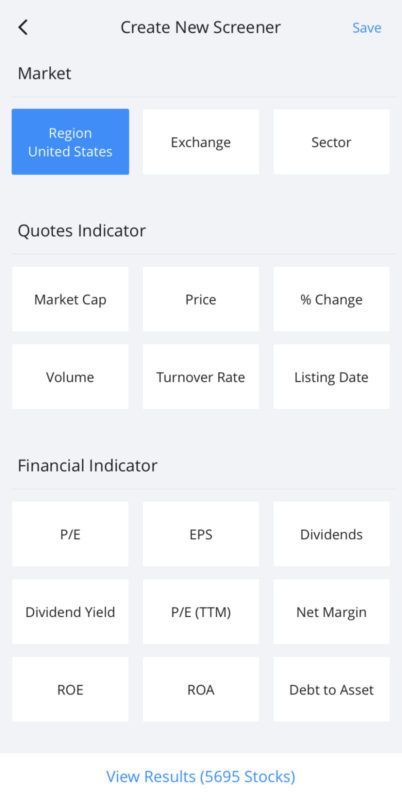

10. Do the apps have a Stock Screener?

Among the three apps, only WeBull has a stock screener that gives a good range of screening options such as market cap, PE ratio, ROE, Dividends etc.

WeBull Stock Screener feature – great for people who want to apply filters to narrow their stock search.

Best Investment App Winner for Criteria 10

WeBull

11. Can you schedule your investments automatically?

Robinhood and M1 Finance have an automatic investment feature, whereas WeBull does not have an automatic investment feature yet.

Best Investment App Winner for Criteria 11

Robinhood and M1

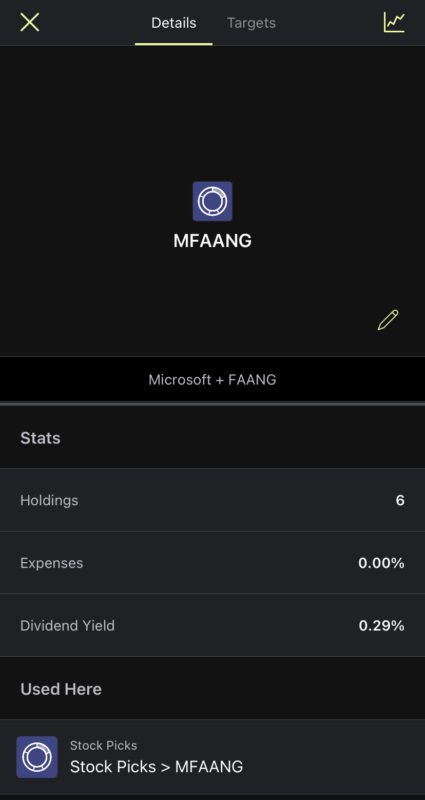

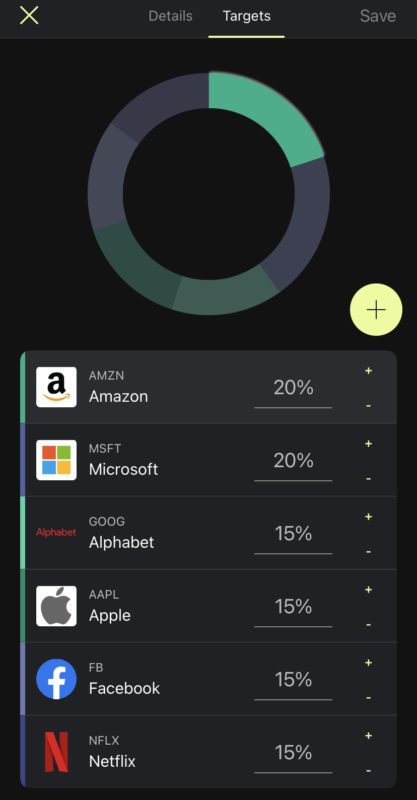

12. Can you create customized portfolios?

While you can separately keep a track of all your investments while investing, the pie and portfolio feature on M1 is a game-changer and it makes building a strategy-based portfolio easier even for beginners.

Best Investment App Winner for Criteria 12

M1

13. Can you copy hedge fund portfolios?

M1 clearly shines here as well with easily accessible portfolio pies for popular hedge funds. M1 also has some pre-build expert pies that users can copy and invest easily.

Best Investment App Winner for Criteria 13

M1

14. What about extended hours trading on Robinhood vs Webull?

- Robinhood: Allows extended hours trading to ‘Gold’ members from 9:00 AM to 6:00 PM Eastern Time

- M1 Finance: Does not allow extended hours trading. In fact, M1 allows only one trade window for regular members, and two trade windows for M1 Plus members every day.

- WeBull: Allows extended hours trading (limit orders only) from 4:00 AM to 8:00 PM Eastern Time.

Best Investment App Winner for Criteria 14

WeBull

Winner of Best Investment App according to the 14 criteria above

- Robinhood – 8 points

- WeBull – 10 points

- M1 Finance – 8 points

As you can see, quantitatively, the competition is very close. However, different users may weigh the different features differently – for some ‘shorting’ the stock may be the most important feature, while for others creating investment pies easily may be the most important feature.

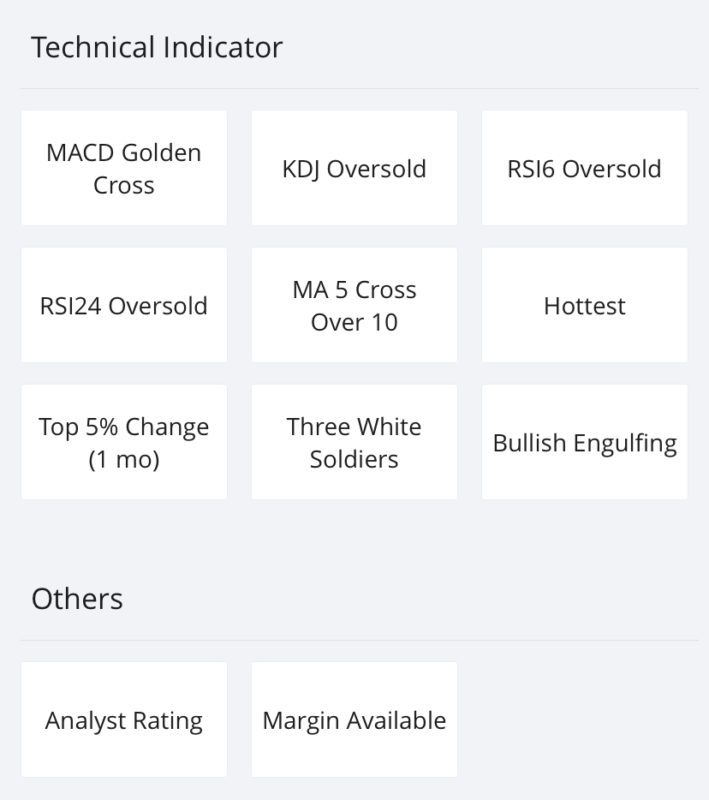

Comparison Table: Robinhood vs M1 Finance vs WeBull

We have put together an easy-to-reference comparison table.

* Even on $0 commission brokerage accounts, other fees may apply, please read fee disclosures for details.

To Summarize, Here Are The Key Features:

- Robinhood: Cryptocurrencies + Stocks + Options + ETFs + aftermarket trading + Partial Shares

- M1 Finance: Stocks + ETFs + great portfolio building features using pies

- WeBull: Cryptocurrencies + Stocks + ETFs + Options + Good Analytics + Simulator + Partial Shares [updated September 8, 2021]

Robinhood

- Cryptocurrencies

- Stocks

- Options

- ETFs

- Extended Hours Trading

- Partial Shares

M1 Finance

- Stocks

- ETFs

- Partial Shares

- great portfolio building features using pies

WeBull

- Cryptocurrencies

- Stocks

- ETFs

- Options

- Good Analytics

- Simulator

- Extended Hours Trading

- Partial Shares (new feature)

Conclusion: Which is the best investment app among Robinhood, Webull and M1 Finance?

It depends! All three apps have some unique features that we love –

- Robinhood for the simplicity of trading stocks, partial shares, ETFs, options, and cryptocurrencies in one place,

- M1 Finance for the ability to create custom pies, portfolios, and partial shares,

- and WeBull for trading stocks, ETFs, options, fractional shares, cryptocurrencies, stock screening feature and exceptional analytics.

It’s a difficult choice to pick just one among all three. The good news is you can open an account with all three because they have $0 account minimums!

Need help getting started with stocks? Check this out.

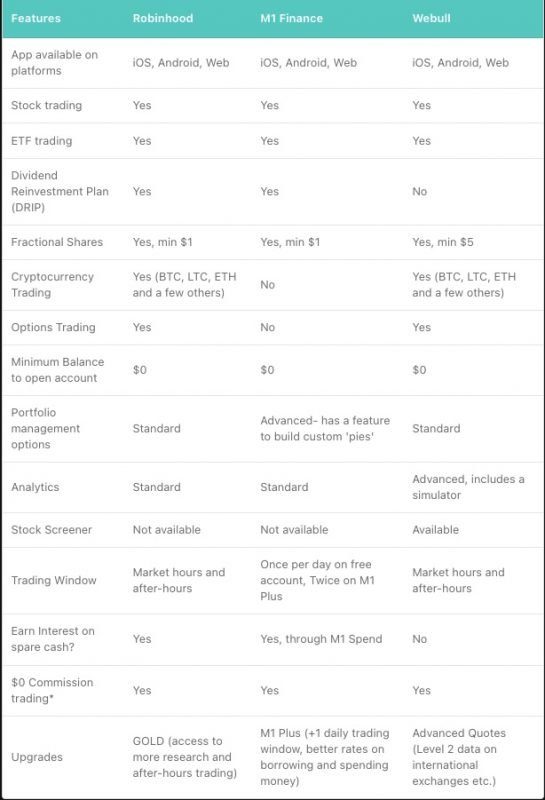

Bonus: Discover Some Cool Features of WeBull

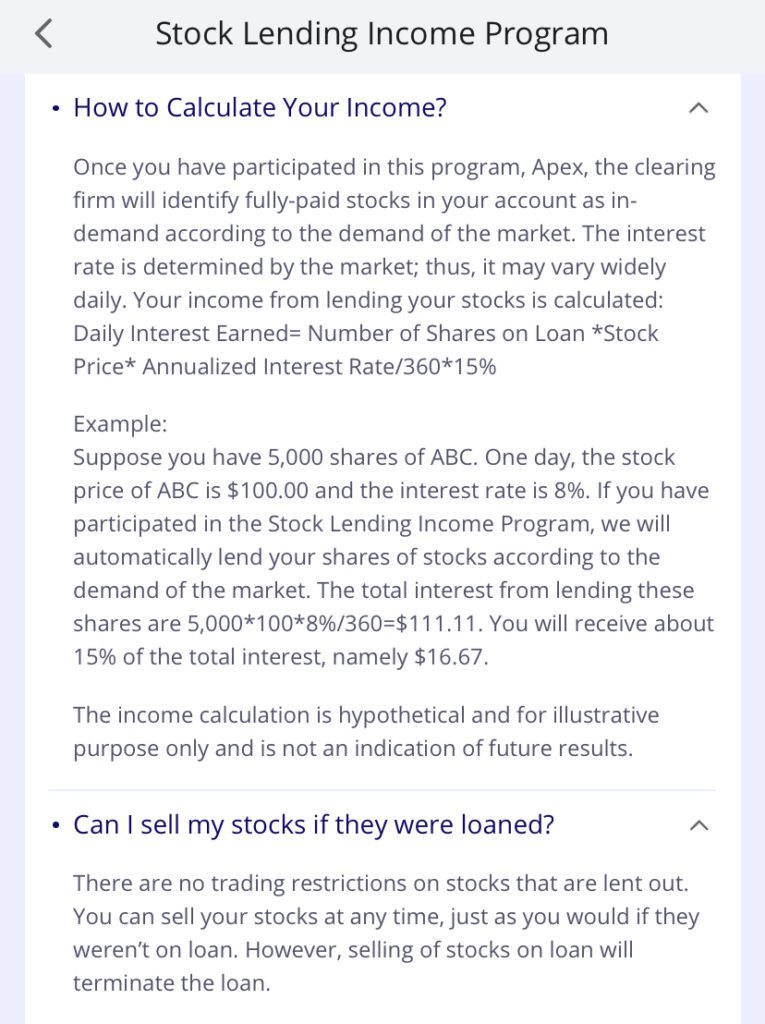

WeBull has Stock Lending Program: Make Extra Income

You can earn extra income from the stocks you fully own (paid fully in cash). You can lend out these stocks to WeBull and earn some interest money for lending the stocks.

There is no special requirement to participate in the stock lending program and no restrictions on selling the stocks. Understandably, when you sell the stocks the ‘loan’ gets terminated.

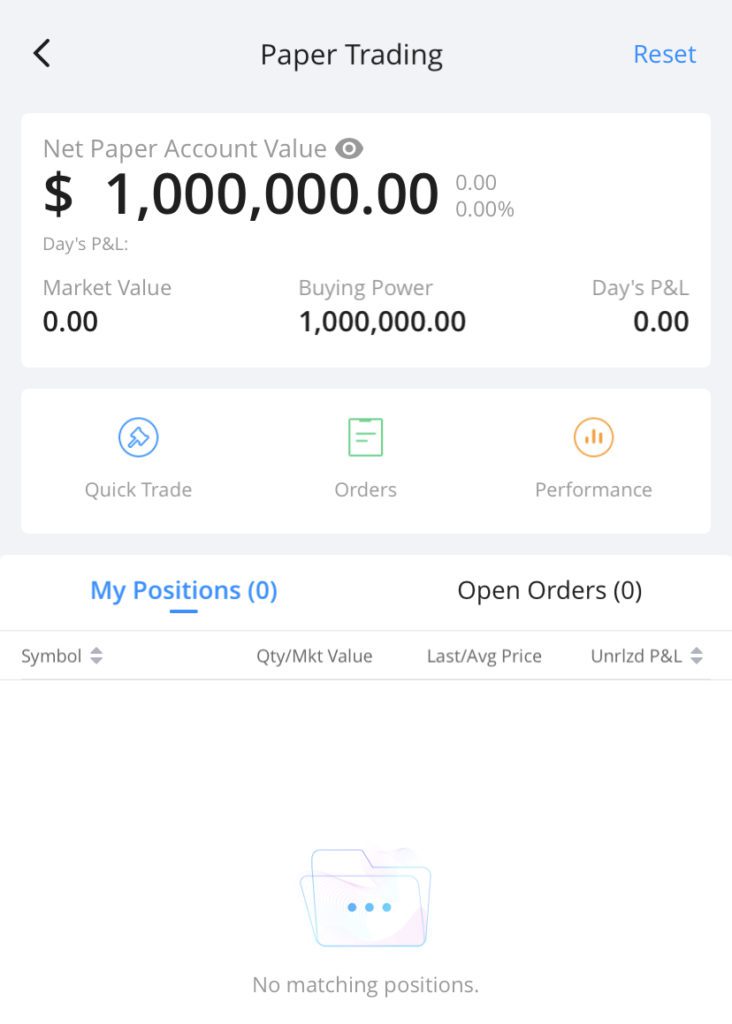

WeBull has Paper Trading Account: Trade Without Money Risks

When you want to feel the thrill of placing bets but don’t want to risk any money, paper trading is perfect for you. The good news is you can learn and avoid losing money. The bad news is your gains are also not real!

Trade Risk Free with Paper Trading Account on WeBull

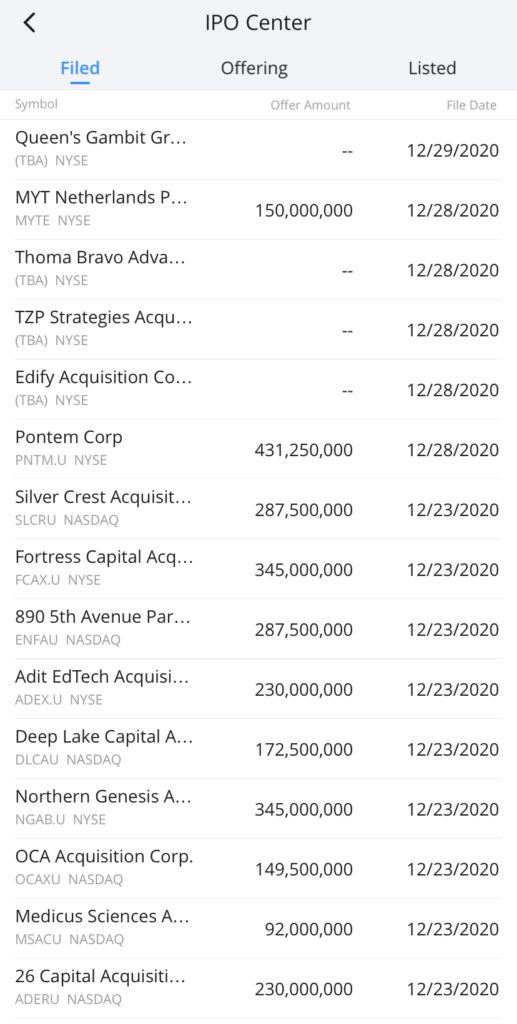

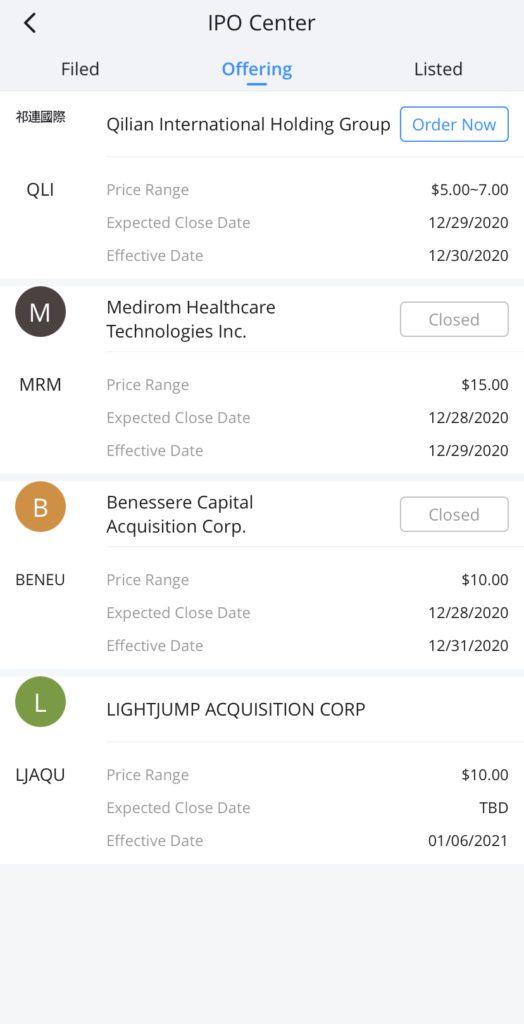

WeBull has an IPO Center on the App

The IPO Center on the WeBull app has three sections – companies that have filed their IPOs (Initial Public Offerings), companies that are offering stocks that you can buy before they get listed on exchange for common trading, and companies that are already listed on exchanges (you can trade these stocks directly on the exchange)

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents