This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

Before we compare the similarities and differences between Call vs Put Options, let’s first understand what are call options and put options in detail. To jump to a particular section, please use the ‘Page Contents’ menu below.

Call Options Explained

Call Options: You buy call options when you believe the stock will go up. A call option is a contract that locks in a purchase price of a stock for you until a given date. Generally, a call option is a contract that allows you to buy 100 shares of stock, at the contract price (called the strike price).

READ THIS BEFORE YOU PUT ANY MONEY INTO CALL OPTIONS.

Trading options is advised only for advanced investors who fully understand how the options work. Let’s understand how a call option works, with the help of an example.

Read Also: How To Buy A Long Call Option on 100 Shares: Step-by-Step Guide

Basic Terminology of Call Options Explained

Basic Terminology:

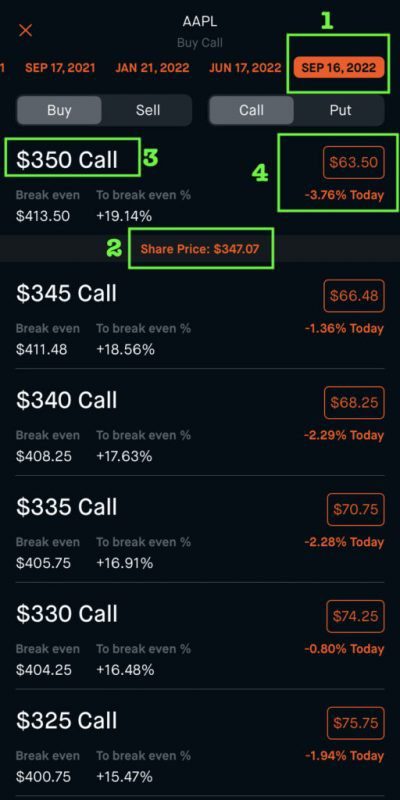

- Expiration date: The date on which the contract expires, Sep 16, 2022 in this case.

- Share Price: This is the share price of the stock in real time (the current market price)

- The Strike Price: This is price i.e. $350 at which you can buy 100 shares of AAPL stock anytime before the expiration date, according to the ‘option’ contract.

- Premium: This is the amount of money you’d pay to buy this ‘option’ contract to lock in a share purchase price @ $350.

Breakeven Price: The price above which the option would bring profits. In this case, breakeven = $350 (strike price) + $63.50 (premium or cost of buying the call option contract) = $413.50

Let’s focus on the highlighted call option. We are looking at AAPL (Apple) stock call options. Why call option? Because we believe the AAPL stock will rise in price over the next two years. We have chosen an expiration date of Sept 16, 2022, and want to bet on Apple’s share price going up.

The contract we are looking at is the $350 call option, which means this contract will lock in a buying price of $350 per Apple share * 100 shares, until Sept 16, 2022, no matter how high or low Apple’s share price goes. For buying this contract, we need to pay a premium – just consider it the cost of the contract – $63.50 per share * 100 shares. So this contract would cost us $6,350.

Let’s say we are a strong believer in Apple stock and want to buy the contract for $6,350 today. Since there’s no guarantee of price rise or price fall in the stock market, we will evaluate a few scenarios to see how much money we can make or lose, depending on how the AAPL stock performs between today and the expiration day of the contract, Sep 16, 2022.

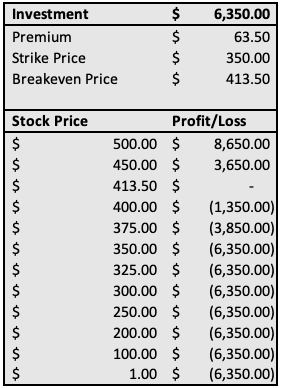

CASE 1: Optimistic Case: AAPL stock hits $500 (i.e. above breakeven price $413.50) before Sept 16, 2022

The market rallies, Apple’s products, and services sell better than expected, the revenues and profits go through the roof, and AAPL hits a $500 stock price. So, how much do we benefit in this case?

Let’s compute the costs and market value of the contract.

If we want to use the contract to actually buy 100 shares, we can do that. According to the contract we can buy 100 shares @ $350 each, so the cost of buying 100 shares is $35,000. We already paid some money to buy the contract, i.e. $63.50 * 100 = $6,350.

Total cost = $35,000 + $6,350 = $41,350

Current Value of 100 AAPL shares = $500 * 100 = $50,000.

Profit = $50,000 – $41,350 = $8,650

Bestseller Personal Finance Books

We can go through the process of actually buying the 100 shares and selling the 100 shares, or we can just sell the contract to someone else without going through the hassle of buying and selling 100 shares.

What is the value of the contract in case we want to sell it now?

The contract is promising a locked-in price of AAPL at $350, and the current market price is $500. So technically the contract is worth $150 now. You can sell the contract for a price around $150 * 100 = $15,000.

The actual price will vary depending on when you’re selling the contract how many days are left before the contract expires (say in Jan 2022 AAPL reaches $500, and you’re selling the contract in Jan 2022 itself, almost 9 months before the contract expires), because the AAPL stock might have more room to grow before the contract expires. In that case, you can fetch a higher price than $15,000 also.

Profit made: $8,650 or 136%

CASE 2: AAPL stock reaches a maximum of $400 (i.e. below breakeven price $413.50, but above the strike price) before Sept 16, 2022

Let’s assume the markets did well, but AAPL stock didn’t really blow everyone out of the water. The stock price climbed up to $400 and that’s the max price before Sept 16, 2022.

What happens now?

We can use the contract to buy 100 shares @ $350 each, costing a total of $35,000. Initially, we had paid $6,350. So our total cost would be $41,350.

At the market price of $400 per share, we can get a maximum of $40,000 for our 100 shares.

So, our costs are higher than the market value of the 100 shares. We now have a problem. We made a loss. How much?

Loss: $41,350 – $40,000 = $1,350

We can buy and sell 100 shares, or we can simply sell the contract to someone else. Technically the price of the contract should now be about $400 – $350 = $50. We can expect to sell it at $50 * 100 = $5000.

Again, as in case 1, the price you’ll fetch by selling the contract could vary, but $5000 is a fair estimate.

Loss incurred: $1,350 or 37%

CASE 3: AAPL stock falls and goes down to $325 (i.e. below breakeven price $413.50 and also below the strike price), without recovering back before Sept 16, 2022

We know that S#@t happens. There’s a trade war or a scandal, or a virus shuts down the world – anything that can be detrimental to AAPL stock happens. The stock falls, and recovers, and falls, and recovers – but is able to climb back to a max of $325 before the expiration date, Sept 16, 2022.

What is the value of our contract now?

Thinking logically, why would anyone want to buy a contract to buy 100 AAPL shares @ $350 each when they can directly buy the AAPL shares at a lower price in the market, i.e. $325 each?

This is where the contract becomes worthless.

Loss incurred: $6,350, the entire premium paid for the call option contract

Key Benefit: Call Option Can Limit Your Losses

Continuing our example in case 3, if we want to use the contract to buy 100 shares, total cost = $35,000 + $6,350 = $41,350. The market value of 100 shares = $32,500

Loss incurred: $41,350 – $32,500 = $8,850

Right?

Wrong!

This is where options are helpful. They can limit your losses while providing you with unlimited upside. Since we had bought the contract that gave us an option to buy 100 shares. We DO NOT have to buy the 100 shares. We will let the contract expire. In this case, we will lose all the value, i.e. $6,350 we initially paid, but we will not have to incur any further loss, no matter whether AAPL stock goes down to $300, $200, $100, or even $0. Imagine buying 100 shares of AAPL at $350 each and the stock goes to $0 !!!

While options can bring great returns or steep losses, the good thing about options is that they limit your losses to the purchase price of the contract, i.e. $6,350 in our example.

Conclusion on Call Options

Call options can be insanely rewarding, they can be excellent for limiting losses, BUT they can very quickly wipe out value too. Options are not for the faint-hearted, and definitely NOT for someone who doesn’t fully understand how options work. The most unfortunate thing in the world of investing is when someone loses money because they didn’t fully understand what they were investing in.

If you know what you are doing, call options can be a great addition to your portfolio.

To summarize:

- If the stock price goes above the breakeven price (cost of contract + strike price i.e. $350 + $63.50 = $413.50), call options can bring accelerated returns to the investor.

- In case the stock price stays below the breakeven price ($413.50), the investor incurs accelerated losses.

- If the stock price falls below the strike price i.e. $350 (and stays below until the expiration date), the investor loses all the money spent on the contract.

- The investor’s loss is limited to money spent on the call option, no matter how low the stock price falls further. A stock price fall from $350 to $0 would not cause any additional loss to the investor.

Apple Call Option Scenarios

Here are a few more cases with stock prices and potential profit or loss for the investor.

Put Options Explained

Put Options: You buy put options when you believe the stock will go down. A put option is a contract that locks in a selling price of a stock for you until a given date. Generally, a put option is a contract that allows you to sell 100 shares of stock, at the contract price (called the strike price).

READ THIS BEFORE YOU PUT ANY MONEY INTO PUT OPTIONS.

Trading options is advised only for advanced investors who fully understand how the options work. Let’s understand how a put option works, with the help of an example.

Read Also: How To Buy A Long Put Option on 100 Shares: Step-by-Step Guide

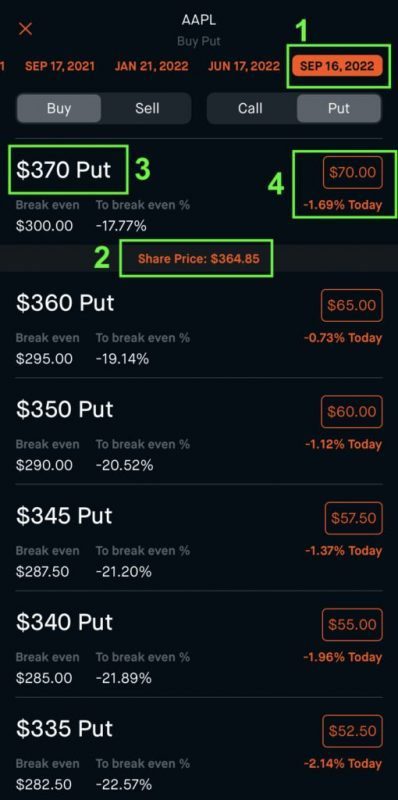

Basic Terminology of Put Options Explained

Basic Terminology:

- Expiration date: The date on which the contract expires, Sep 16, 2022, in this case.

- Share Price: This is the share price of the stock in real-time (the current market price)

- The Strike Price: This is the price i.e. $370 at which you can sell 100 shares of AAPL stock anytime before the expiration date, according to the ‘option’ contract.

- Premium: This is the amount of money ($70 x 100 = $7,000) you’d pay to buy this put ‘option’ contract to lock in a share selling price of $370.

Let’s focus on the highlighted put option. We are looking at AAPL (Apple) stock put options. Why put option? Because we believe the AAPL stock will fall in price over the next two years. We have chosen an expiration date of Sept 16, 2022, and want to bet on Apple’s share price going down.

The contract we are looking at is the $370 put option, which means this contract will lock in a selling price of $370 per Apple share * 100 shares, until Sept 16, 2022, no matter how low Apple’s share price goes. For buying this contract, we need to pay a premium – just consider it the cost of the contract – $70 per share * 100 shares. So this contract would cost us $7,000.

Let’s say we believe that the Apple stock is overvalued and anticipate it to fall. So, we want to buy the contract for $7,000 today. Since there’s no guarantee of price rise or price fall in the stock market, we will evaluate a few scenarios to see how much money we can make or lose, depending on how the AAPL stock performs between today and the expiration day of the contract, Sep 16, 2022.

CASE 1: AAPL stock falls and hits a rock bottom price of $100 before Sept 16, 2022

The market crashes, Apple’s share price tanks, and AAPL’s price hits a low of $100 per share. So, how much do we benefit in this case?

Let’s compute the costs and market value of the contract.

If we want to use the contract to actually sell 100 shares, we can do that. According to the contract we can sell 100 shares @ $370 each, so we can buy 100 shares directly from the market at $100 each, i.e. for a total of $10,000, and sell them for $370 each, i.e. $37,000 in total.

Total cost of 100 shares and ‘put option’ contract = $10,000 + $7,000 = $17,000

Selling Value of 100 AAPL shares according to the ‘put option’ contract = $370 * 100 = $37,000

Profit = $37,000 – $17,000 = $20,000

We can go through the process of actually buying the 100 shares and selling the 100 shares, or we can just sell the contract to someone else without going through the hassle of buying and selling 100 shares.

What is the value of the contract in case we want to sell it now?

The contract is promising a locked-in selling price of AAPL at $370, and the current market price of AAPL shares is $100. So technically the contract is worth $270 now. You can sell the contract for a price around $270 * 100 = $27,000.

The actual price will vary depending on when you’re selling the contract how many days are left before the contract expires (say in Jan 2022 AAPL reaches $100, and you’re selling the contract in Jan 2022 itself, almost 9 months before the contract expires), because the AAPL stock might have more room to fall before the contract expires. In that case, you can fetch a higher price than $27,000 also.

Profit made: $20,000 or 186%

CASE 2: AAPL stock reaches a low of $320 before Sept 16, 2022

Let’s assume the markets fell a bit, but AAPL stock didn’t really crash. The stock price went down to $320 and that’s the lowest price before Sept 16, 2022.

What happens now?

We can use the contract to sell 100 shares @ $370 each, valuing the sale at $37,000. We can buy the 100 shares from the market at $320 each for a total of $32,000. Initially, we had paid $7,000 for the ‘put option’ contract. So our total cost would be $32,000 + $7,000 = $39,000.

At the locked-in selling price of $370 each, we can get $37,000 by selling the 100 shares.

So, our costs ($39,000) are higher than the contract price value of 100 shares ($37,000). We now have a problem. We made a loss. How much?

$37,000 – $39,000 = -$2,000

We can buy and sell 100 shares, or we can simply sell the contract to someone else. Technically the price of the contract should now be about $370 – $320 = $50. We can expect to sell it at $50 * 100 = $5000.

Again, as in case 1, the price you’ll fetch by selling the contract could vary, but $5000 is a fair estimate.

Loss incurred: $2,000 or 28.6%

CASE 3: AAPL stock rises and goes up to $400 and doesn’t fall from there before Sept 16, 2022

We know that markets can be unpredictable. In the middle of a pandemic and economic contraction, the shares just keep rising! The stock keeps rising and goes to hit $400 before the expiration date, Sept 16, 2022.

What is the value of our contract now?

Thinking logically, why would anyone want to buy a contract to sell 100 AAPL shares @ $370 each when they can directly sell AAPL shares at $400 each in the market?

This is where the contract becomes worthless.

Loss incurred = $7000 (entire premium)

Key Benefit: Put Option Can Limit Your Losses

Continuing our example in case 3, if we want to use the contract to sell 100 shares, total cost = $40,000 + $7,000 = $47,000. The selling value 100 shares according to ‘put option’ contract = $37,000

Loss incurred: $37,000 – $47,000 = -$10,000

Right?

Wrong!

This is where put options are helpful. They can limit your losses. Since we had bought the contract that gave us an option to sell 100 shares. We DO NOT necessarily have to sell the 100 shares. We will let the contract expire. In this case, we will lose all the value, i.e. $7,000 we initially paid, but we will not have to incur any further loss, no matter whether AAPL stock goes up to $400, $500, or goes berserk and hits $1,000.

While put options, much like call options, can bring great returns, or steep losses, the good thing about options is that they limit your losses to the purchase price of the contract, i.e. $7,000 in our example.

Conclusion on Put Options

Put options can be insanely rewarding, they can be excellent for limiting losses, BUT they can very quickly wipe out value too. Options are not for the faint-hearted, and definitely NOT for someone who doesn’t fully understand how options work.

If you know what you are doing, put options can be a great addition to your portfolio.

To summarize:

- If the stock price goes below the breakeven price ( strike price – the cost of contract i.e. $370 – $70 = $300), put options can bring accelerated returns to the investor.

- In case the stock price stays above the breakeven price ($300), the investor incurs accelerated losses.

- If the stock price rise above the strike price i.e. $370 (and stays above that until the expiration date), the investor loses all the money spent on the contract.

- The investor’s loss is limited to money spent on the put option, no matter how high the stock price rises further. A stock price jump from $370 to $1000 would not cause any additional loss to the ‘put option’ investor.

Call vs Put Options Comparison: Similarities and Differences

We will compare the call vs put options on the 5 criteria:

- the key feature, i.e. what is the purpose of the option contract

- costs associated, i.e. whether we have to pay to buy the option contract

- max profit possible in the trade

- max loss possible in the trade

- breakeven point

For more on Stock Options, check out StartOptions.com

Read also: Straddle vs Strangle Options

- Call Options Explained

- Basic Terminology of Call Options Explained

- CASE 1: Optimistic Case: AAPL stock hits $500 (i.e. above breakeven price $413.50) before Sept 16, 2022

- CASE 2: AAPL stock reaches a maximum of $400 (i.e. below breakeven price $413.50, but above the strike price) before Sept 16, 2022

- CASE 3: AAPL stock falls and goes down to $325 (i.e. below breakeven price $413.50 and also below the strike price), without recovering back before Sept 16, 2022

- Key Benefit: Call Option Can Limit Your Losses

- Conclusion on Call Options

- Put Options Explained

- Basic Terminology of Put Options Explained

- Key Benefit: Put Option Can Limit Your Losses

- Conclusion on Put Options

- Call vs Put Options Comparison: Similarities and Differences

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents