This article has been reviewed by Sumeet Sinha, MBA (Emory University Goizueta Business School). Should you have any inquiries, please do not hesitate to contact at sumeet@finlightened.com.

Are you looking for a top-grade and best credit card for consultants? Without any prior knowledge, it may seem daunting to you. Fear not, once done with this article, you will have a fair bit of idea about choosing a credit card that is not only the best but also the right one.

Best Credit Card For Consultants (Jump To Section)

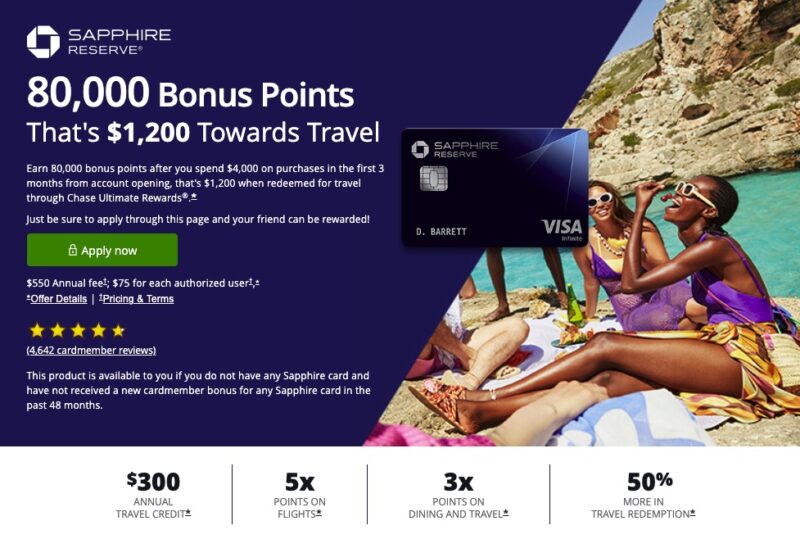

Chase Sapphire Reserve Offer

A credit card that is good for you may not be the best for me. If you are on the lookout for the best credit card for consultants then you may also need to go through some proper research. Through proper research work, you will get to know which one is the best pick for you as well as which will make the best sense as per your expenses. You need to keep in mind that there is no such credit card as a one-size-fits-all.

Even though every credit card has its unique perks and benefits, there can be drawbacks too. So, getting the best credit cards for consultants needs some research work. Here we will add a few factors which will help you in finding the best credit card for consultants.

Read more: How To Use Credit Card Responsibly

Best Credit Card For Consultants

- 1. American Express Gold Credit Card

- 2. AMEX Premier Rewards Credit Card

- 3. Capital One Aspire Travel Credit Card

- 4. Chase Sapphire Preferred Credit Card

- 5. RBC Visa Card

- 6. CIBC Aventura

- 7. BMO Air Miles Mastercard

- 8. TD Gold Elite Visa

- 9. Chase Freedom Unlimited Credit Card

- 10. The Hilton Honors American Express Business Card

How To Pick The Best Credit Card For Consultants?

To get the best credit card for consultants, you need to ask the right questions all while knowing your options as well. When you know about your preferences, you will get the perfect fit for your spending goals and financial betterment.

Here is how you can find out the best credit card for consultants.

- Check your credit

- Select a goal for the credit card

- You can narrow your choices by asking the right questions

- Get ready to apply for the best credit card for consultants with the highest overall value

It’s time to explore these factors so that you can make your decision clear and appropriate.

1. Check your credit

You can consider checking your credit score as the first step. It will be easier for you to look into your credit score to get the perfect fit for you because it will determine your eligibility for the credit card. Most top-graded credit cards, especially those with huge rewards, demand a good credit score of at least 720-plus. You can also find out credit cards for people with fair credit scores. If you need a card with no credit history or limited credit history, we must say it is also available.

You can make your credit history good by clearing all your bills on time. Also, you can pay outstanding debts to lower your credit utilization. Never skip any bill and if you do so, you can get a negative remark on your credit report. It may drop your credit score. So before applying, keep an eye on your credit score.

2. Select a goal for the credit card

Usually, three types of credit cards are available:

- Credit cards that help you in improving your credit when it is damaged.

- Credit cards that save your money on interest.

- Credit cards that help you to get huge rewards.

When you are choosing the best credit card for consultants, you need to check your specific needs. Also, you can choose a credit card that comes with an introductory 0% APR (Annual Percentage Rate) as well as ongoing low interest. This kind of credit card is perfect for any emergency usage. Also if you have an irregular source of income, then you can also choose this card.

If you have a proper source of income every month, do not hesitate at all to go for a card with huge rewards and benefits. Though these kinds of cards come with higher annual fees, these cards will provide you with huge sign-up bonuses, points, miles & reward points, cashback offers on every buck you spend.

3. You can narrow your choices by asking the right questions

Whenever you are thinking of getting a perfect fit for yourself, you can ask yourself a lot of questions. It may help you to narrow your choices. You should consider things like what is the balance transfer policy, how to get rewards on every penny, what is ongoing interest APR, how you can spend money on the card, how quickly you can earn rewards and benefits, and how much those benefits are worth.

Apart from this, you should know about the details on interest rates on credit cards. Some fees are also associated with credit cards. These can be an annual fee, balance transfer fee, late payment fee, cash advance fee, foreign transaction fees, etc. You need to know about all these beforehand. When you will get a clear answer to each of these questions, you will get the best credit card for consultants.

Bestseller Personal Finance Books

4. Get ready to apply for the best credit card for consultants with the highest overall value

As a consultant, you need to get a credit card that offers a higher value. You may find a few credit cards that offer you an introductory 0% interest for up to a few months as a welcome bonus. Some of them also come with no penalty APR or late fees. It may help you to save money. There are a few credit cards for consultants which offer rewards like cash back, air miles, loyalty program points, etc.

You can choose these cards to get various offers. Last but not least, a few cards come with no or low annual fees. Especially those cards which offer huge rewards may demand annual fees. So, whenever choosing the best credit card, you should have proper knowledge about these variables beforehand.

A few extra points to consider before moving forward to the best credit cards for consultants

Consultants are always traveling, moving to various cities, roaming by cars, cabs etc. You can look into credit cards that give you huge cashback offers as well. You can also choose a card that offers you a lot of discounts when you go shopping, go out for a meeting with your clients, etc. Through this kind of card, you will be able to save a lot of money.

Apart from all of these, you have to consider gas and oil because these are essential expenses of daily life. A few credit cards provide you with a lot of discounts on gas money. You can also choose a credit card that gives a lot of perks and benefits while traveling. These may include offers on hotel booking, dining, shopping etc.

Now you are well acquainted with how to choose your best credit card for consultants, it is time to learn about the best picks for 2022.

Best Credit Card For Consultants

Here is the list of a few best credit cards for consultants.

- 1. American Express Gold Credit Card

- 2. AMEX Premier Rewards Credit Card

- 3. Capital One Aspire Travel Credit Card

- 4. Chase Sapphire Preferred Credit Card

- 5. RBC Visa Card

- 6. CIBC Aventura

- 7. BMO Air Miles Mastercard

- 8. TD Gold Elite Visa

- 9. Chase Freedom Unlimited Credit Card

- 10. The Hilton Honors American Express Business Card

Here are a few details about these credit cards.

1. American Express Gold Credit Card

On the American Gold Express Credit card, you are going to get 40,000 reward points when you charge $1,500 to your card in your first 3 months as a welcome bonus. This credit card enables you to receive up to 3 rewards per $1 spent, which buys you roundtrip tickets to exotic destinations. If you are one of them who are frequent flyers, you should go for this card because it will help you in earning lots of travel reward points.

Every year you can get $200 travel credits. You can make use of this credit for any travel booking made with the Amex Travel office, any cash-back transaction within the travel category, a round-trip short-haul flight booking made with your Air Canada, etc.

Apart from these, you will also earn a $50 annual membership fee credit. Though this American Gold Express Card comes with an annual fee of $120, you are likely to get huge benefits from this card.

2. AMEX Premier Rewards Credit Card

The AMEX Premier Rewards Gold Card is another good credit card for consultants. It is going to give you quite interesting facilities like two points for every $1 spent on travel and gas. As a welcome bonus reward, you will be credited with 40,000 points as long as you spend $1,000 within the first 3 months. You will also receive $100 credit rewards that can be used flexibly for various travel purposes.

You may use these travel rewards for different travel purchases. You can use this card for purchases made directly through the air or hotel companies, Purchases through various travel agents are also welcome on this AMEX Premier Rewards Gold Card.

3. Capital One Aspire Travel Credit Card

Capital One Aspire Travel Credit Card is quite famous among travelers because it is one of the cheapest credit cards. This card comes with no such annual fee. Rather you will receive 10,000 bonus miles when you sign up for the card. Along with this credit card, you are going to get a free supplementary card that does not have an annual fee. On this extra card, you will get 1.25 miles for every $1 you spend on travel and dining.

In case you pick the premium version of this card, you will get 25,000 miles welcome bonus. You will also get a 2 percent rebate on every dollar you spend on travel or dining. You are also eligible for a $120 travel credit. This credit can be used in various ways. You may make use of 50,000 miles if you spend $15,000 on the card annually. Also, there is a scope to use 3,900 miles if you spend $15,000 on the card annually. So, this card can be the best option for frequent travelers.

4. Chase Sapphire Preferred Credit Card

Almost every single person is trying to get this credit card because of its unbelievable benefits. As a welcome bonus, you are going to get 50,000 points if you spend $4,000 within 3 months of opening your account. As a Chase Sapphire card owner, you can earn double the rewards on dining and travel. Apart from this, you can get 1.25 points for every $1 you spend on all other purchases. Apart from this, you can get 1.25 points for every $1 you spend on regular purchases. Another 2 points for every $1 you spend on travel and dining is available when you will make use of this credit card.

On this card, you can also get rewards on regular purchases. If you spend $12,000 annually and your regular purchases come under this, you’ll get 7,000 points just from regular purchases. No doubt, this card is one of the best credit cards for consultants.

5. RBC Visa Card

RBC Visa Credit Card can be one of the best cards for you if you like a simple and easy-to-use credit card with great beneficial rewards. As a welcome bonus, you will get a bonus of 25,000 points when you spend $500 on the card in the first 3 months. You will also get $120 in reward money each year that can be used by you on regular expenses. You will also earn 1 point per $1 spent on regular purchases and 2 points per $1 spent on RBC Touch Banking.

6. CIBC Aventura

CIBC Aventura Credit card is another good option for you. This card gives a welcome bonus of 25,000 points when you spend $1,000 in the first 3 months. Through daily purchases, you will also earn 2 points for every $1 spent. Another interesting fact is you can get 10 percent off all flights with Aventura Rewards.

While traveling or booking a hotel, you may use your Aventura points to pay for hotels at their retail value. It is like 1 Aventura Point is worth $1.25 in Canada and 1.6 Avion point is worth 1 American cent. You can get up to $50 in cash back on this credit card and there is a $120 travel bonus too for you.

7. BMO Air Miles Mastercard

The BMO Air Miles Classic Mastercard provides you with the highest reward value of any credit card. On this credit card, you will earn a one-time bonus of 15,000 Air Miles when you spend $500 on the card. This credit card offers 1 air mile per $10, which works out to a 1.25% return on your spending. You will also get a $100 annual air travel credit that you can use towards your travel expenses. From the BMO Air Miles World Mastercard, you will get 2 miles for every $10 spent, for a return of 1.25%, which is quite a lucrative offer.

8. TD Gold Elite Visa

Another interesting and lucrative credit card is TD Gold Elite Visa Credit Card. On this card, you will earn 1 extra mile for every $1 you spend, which gives you a 2.313% return on your spending. When you redeem your rewards, you will get 1.5 cents toward travel purchases with the airline of your choice. This card comes with an annual fee of $60. If you spend over $60,000 on the card every year, then you’ll earn your next year’s annual fee for free.

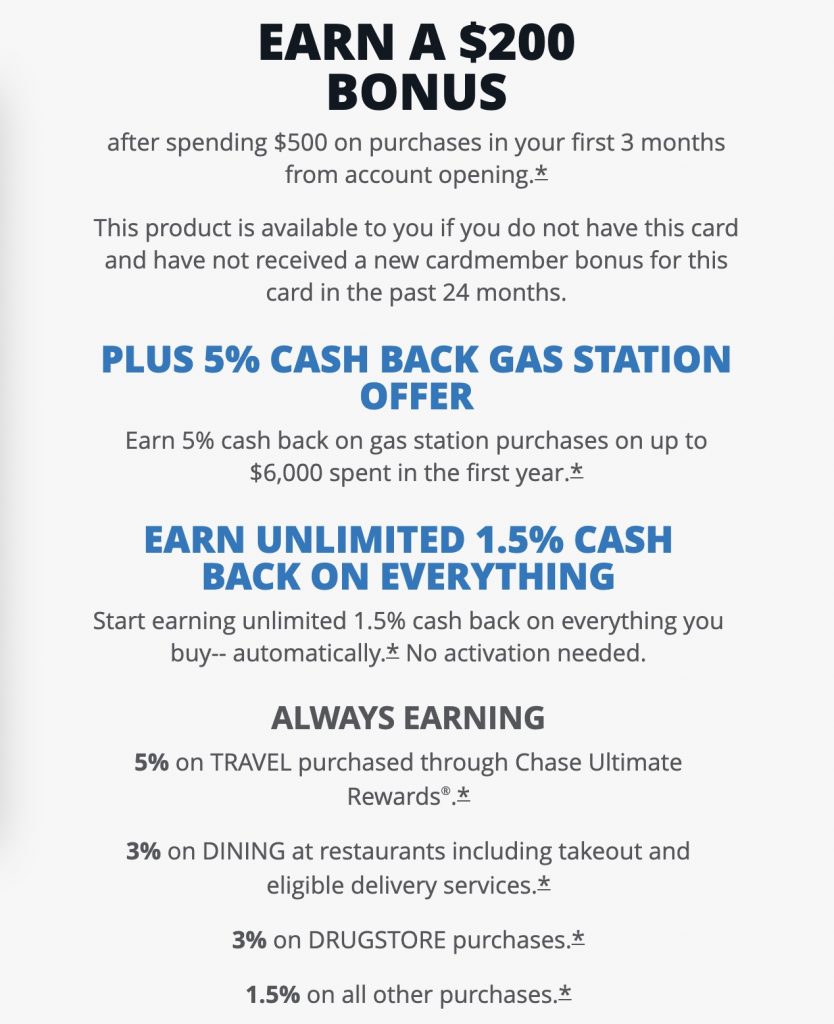

9. Chase Freedom Unlimited Credit Card

The Chase Freedom Unlimited is one of the most tempting cards that exist. This card is going to offer you up to two hundred dollars if you are purchasing $400 to $500. Though this is a welcome bonus and you need to make use of this offer within the first three months of account opening. As a frequent traveler, you can avail 5% discount on the total purchases you make. The most important thing is all of those benefit scores with no annual fees.

CHASE FREEDOM UNLIMITED OFFER

The credit rewards on this card will never expire as long as you are actively using this card for your expenses or other booking or traveling purpose. The initial APR is 0% on this card. After one year, this rate will vary from 14 % to 25%. It is not a big deal as the card offers you a lot more. The only thing you need to keep in mind is that the card is going to charge foreign fees.

10. The Hilton Honors American Express Business Card

The Hilton Honors American Express Business Card is going to be the best one for you if you want to stay within various Hilton properties. It includes Homewood Suites, Hampton Inn, Home2, Hilton Garden Inn etc. As a welcome bonus, you can earn 130,000 Hilton Honors Bonus Points after spending $3,000 in purchases on the Card in the first 3 months of Card Membership.

This card comes with an annual fee of $95. If you want to get a proper value on this card, you need to spend a minimum of $15,000 annually which will lead you to get a free weekend night certificate. Additionally, spending another $45,000 (or $60,000 a year) will provide you with a second free night certificate.

You will also earn 10 free Priority Pass airport lounge visits and complimentary Hilton Honors Gold Status every year. This Hilton Honors Gold Status offers complimentary hotel breakfast and space-available room upgrades. You will also get various bonus points like 12X on hotels and resorts in the Hilton portfolio or 6X at US Gas stations or flights booked directly with airlines or with Amex Travel. You can also get 3X points on other eligible purchases on this card.

Chase Sapphire Reserve Offer

Conclusion

Picking a credit card being a consultant, you need to keep in mind lots of factors such as cashback offers, hotel booking offers, air miles, loyalty program offers, etc. These things will make or break your credit card using experience. Apart from these, facilities like offers on gas and oil, dining reward points, etc. can be pivotal to making the right decision for the perfect fit. Choosing a credit card can be tough, but with us, you can make your decision easier. We hope this article helps resolve your doubts.

Read more:

- 4 Best Credit Cards For Nannies

- 8 Best Credit Cards for Nurses

- 9 Best Credit Cards for Wedding Expenses

- 10 Best Credit Cards For Consultants

- 8 Best Credit Cards For Golf Lovers

- 6 Best Credit Cards for Traveling Consultants

- How to Use Credit Card Responsibly: 7 Must-Have Credit Habits

- Plastic Money – 3 Huge Payment Networks – Visa, Mastercard, and American Express

- Apple Pay and Google Pay – Which Is Better Among Top 2 Services?

- 8 Cool Benefits of Obtaining A Personal Loan – When to Consider It?

Read more

Popular Topics: Stocks, ETFs, Mutual Funds, Bitcoins, Alternative Investing, Dividends, Stock Options, Credit Cards

Posts by Category: Cash Flow | Credit Cards | Debt Management | General | Invest | Mini Blogs | Insurance & Risk Mgmt | Stock Market Today | Stock Options Trading | Technology

Useful Tools

Student Loan Payoff Calculator | Mortgage Payoff Calculator | CAGR Calculator | Reverse CAGR Calculator | NPV Calculator | IRR Calculator | SIP Calculator | Future Value of Annuity Calculator

Home | Blog

Our Financial Calculator Apps

Page Contents